At a glance

- Calgary rents ease from last winter, led by the City Centre and Southwest

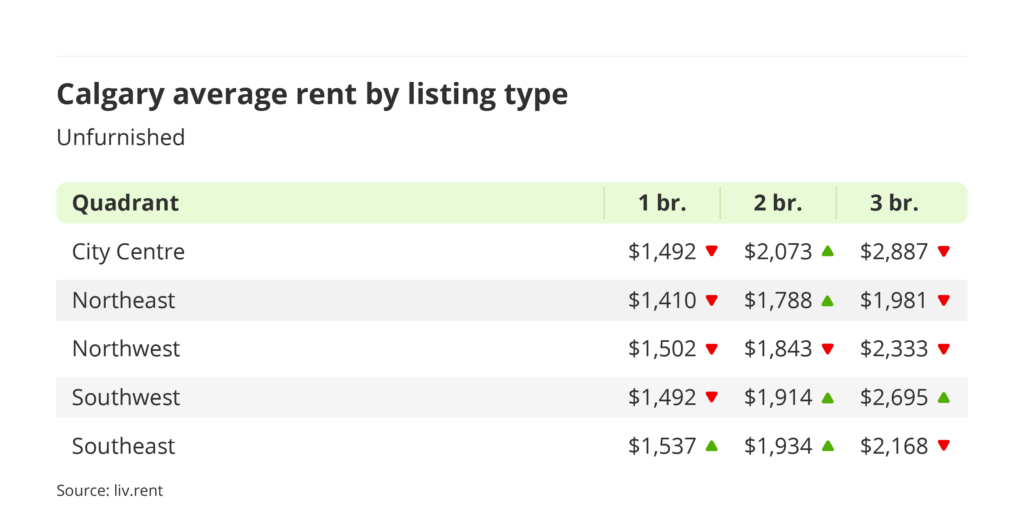

- Across Calgary, unfurnished one-bedroom rents are lower than January 2025 in every submarket. Calgary City Centre fell from about $1,691/month to $1,492/month (−12%), while the Southwest dropped roughly -9%. Two-bedroom unfurnished rents also softened across most areas, showing Calgary’s post-boom cooling is still ongoing.

- Across Calgary, unfurnished one-bedroom rents are lower than January 2025 in every submarket. Calgary City Centre fell from about $1,691/month to $1,492/month (−12%), while the Southwest dropped roughly -9%. Two-bedroom unfurnished rents also softened across most areas, showing Calgary’s post-boom cooling is still ongoing.

- Edmonton remains stable, with only modest year-over-year movement

- Edmonton rents have changed far less than Calgary’s. Unfurnished one-bedroom rents are down 2–8% year-over-year across most districts, while unfurnished two-bedroom prices are largely flat. This steadier pattern suggests Edmonton demand remains balanced, without the sharper reset seen in Calgary.

- Edmonton rents have changed far less than Calgary’s. Unfurnished one-bedroom rents are down 2–8% year-over-year across most districts, while unfurnished two-bedroom prices are largely flat. This steadier pattern suggests Edmonton demand remains balanced, without the sharper reset seen in Calgary.

- Family-sized units see the biggest pullback in Calgary

- Unfurnished three-bedroom rents have declined meaningfully across Calgary since January 2025. Calgary Northwest fell from about $2,569/month to $2,333/month (−9%), while the Southeast dropped roughly 5%. These declines point to softer demand for larger units as affordability pressures continue.

- Unfurnished three-bedroom rents have declined meaningfully across Calgary since January 2025. Calgary Northwest fell from about $2,569/month to $2,333/month (−9%), while the Southeast dropped roughly 5%. These declines point to softer demand for larger units as affordability pressures continue.

Download The Latest Calgary and Edmonton Rent Reports

For the complete Calgary and Edmonton rent reports, download here.

liv.rent’s 2025 Canada Rental Market Trend Report is now live! Explore the latest rental trends across Canada, uncover key factors driving price changes, and gain exclusive insights into how landlords and renters perceive the market nationwide. Download your copy here.

Enjoy the biggest savings this holiday!

Save up to 40% on ads, tenant screening, and more — everything you need to rent out your listing faster and with confidence. Purchase now and redeem your credits anytime within 12 months.

On December 10th 2025, the Bank of Canada announced that it would maintain the interest rate at 2.25%, marking the final rate for 2025.

Let’s take a look now at the current rental costs and overarching trends in Calgary and Edmonton for January 2026. Don’t forget, you can download the entire report as a one-page infographic PDF below.

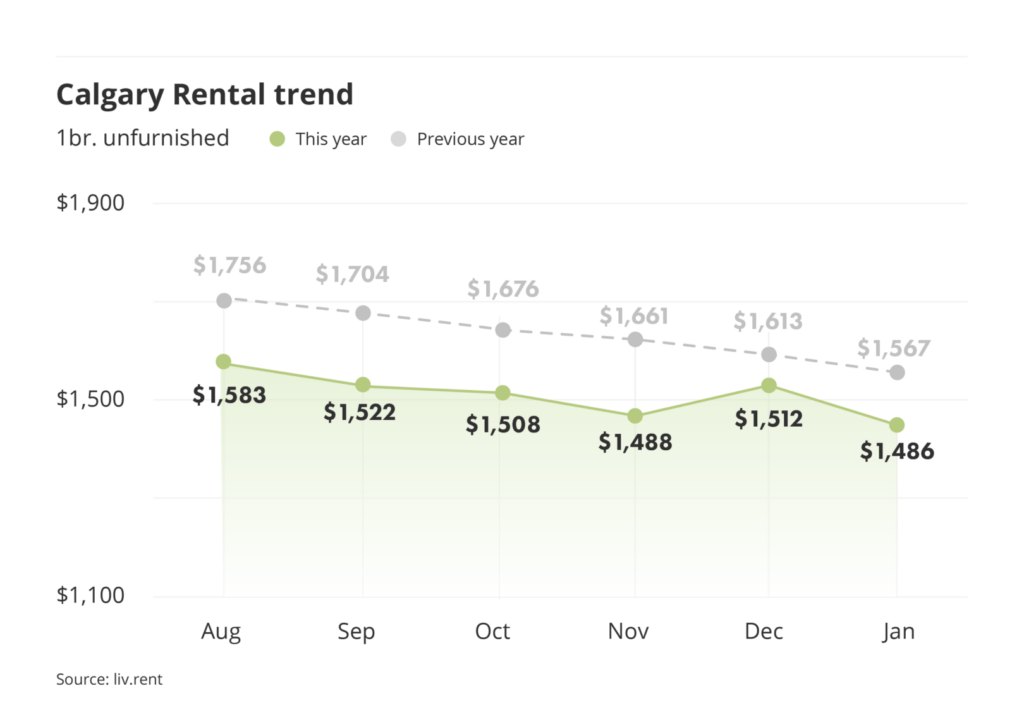

Average rent across Calgary

This January, Calgary’s city-wide average monthly rent price for an unfurnished one-bedroom unit decreased by $26, bringing the rate for an unfurnished one-bedroom unit to $1,486/month.

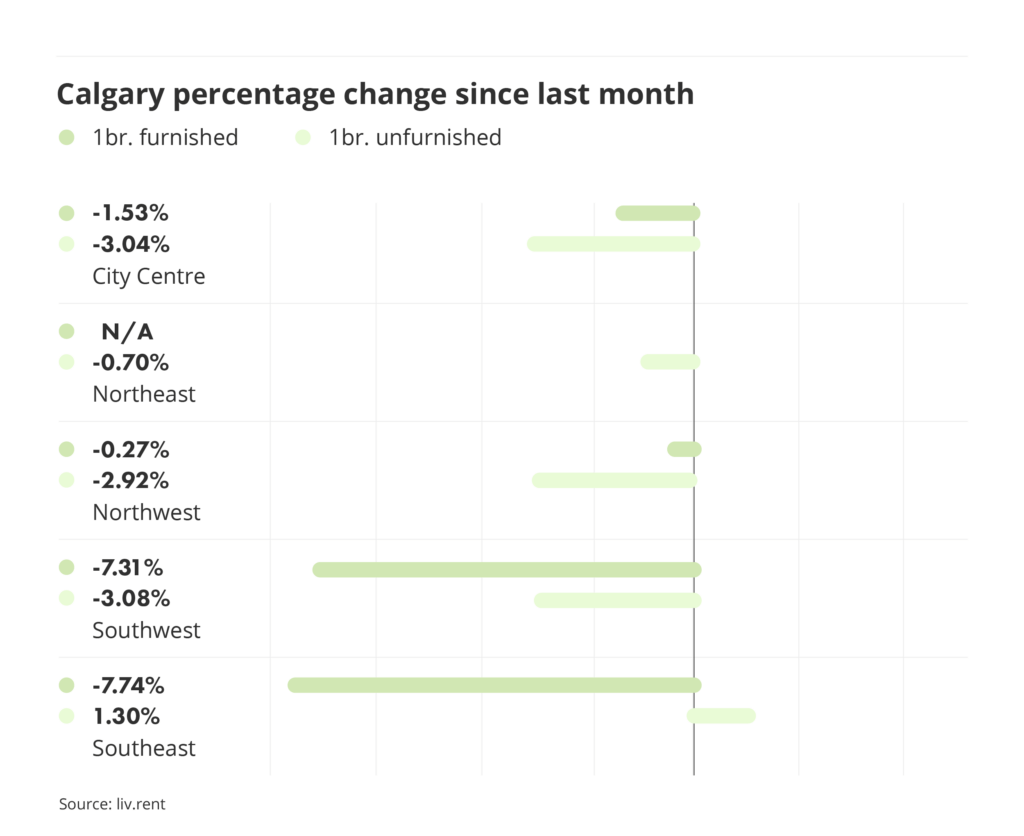

Month-to-month rent change

This chart breaks down the percentage change in rent prices across all of Calgary’s quadrants between December and January 2026.

Calgary saw only decreases for furnished one-bedroom units, lead by Southeast (-7.74%), and followed by Southwest Calgary (-7.31%) and City Centre (-1.53%). More decreases were seen across Calgary, including unfurnished one-bedroom units in Southwest Calgary (-3.08%), City Centre (-3.04%), and Northwest Calgary (-2.92%), and a minor increase was seen in Southeast Calgary (1.30%).

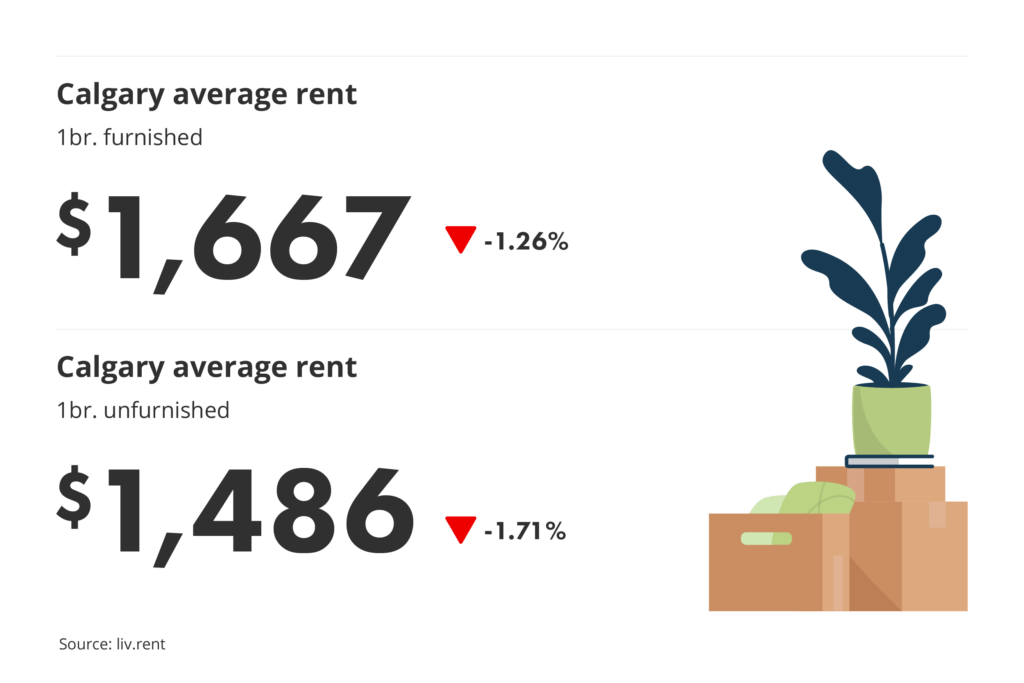

Average unfurnished vs furnished rates

Unfurnished vs furnished rates in Calgary

Average rates for furnished one-bedroom units in Calgary decreased this month, as did unfurnished units. The average monthly rent for an unfurnished one-bedroom unit decreased (-1.71%) to an average of $1,486/month this month. Prices for furnished one-bedroom units also decreased this month (-1.26%), to a new average cost of $1,667/month.

At present, furnished units cost an average of $181 more per month to rent than unfurnished units. This means that landlords are likely to earn a higher profit by renting their units furnished.

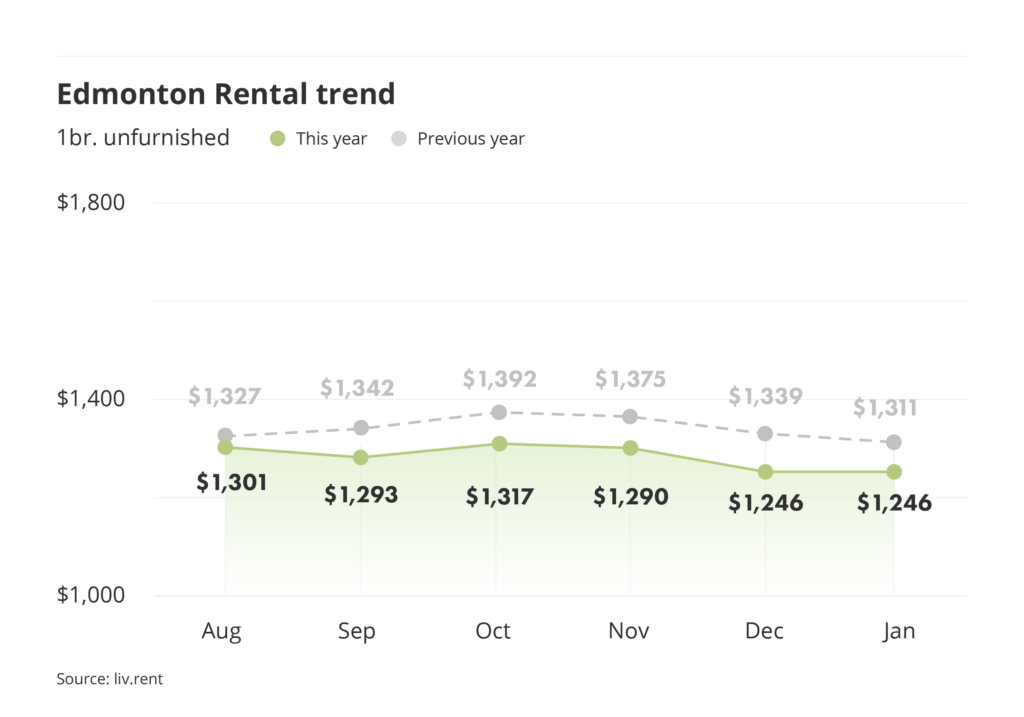

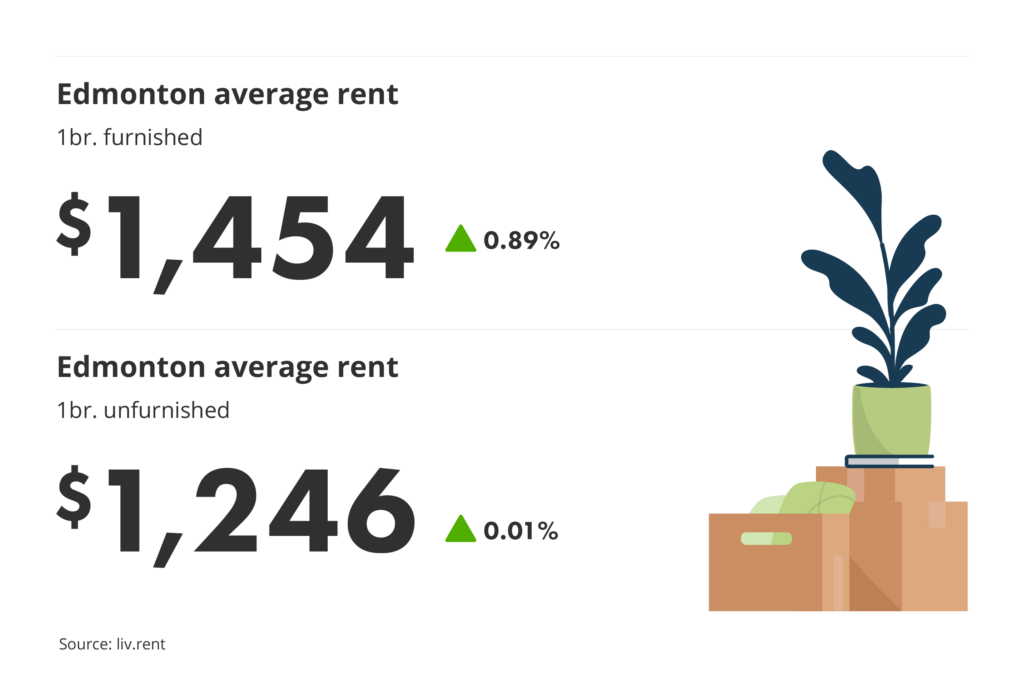

Average rent across Edmonton

This month, Edmonton’s rental rates for an unfurnished one-bedroom unit surprisingly remained the same as last month, maintaining Edmonton’s average monthly rent at $1,246/month. There is a difference from last year, when rent prices were $65 more than this January’s average rent.

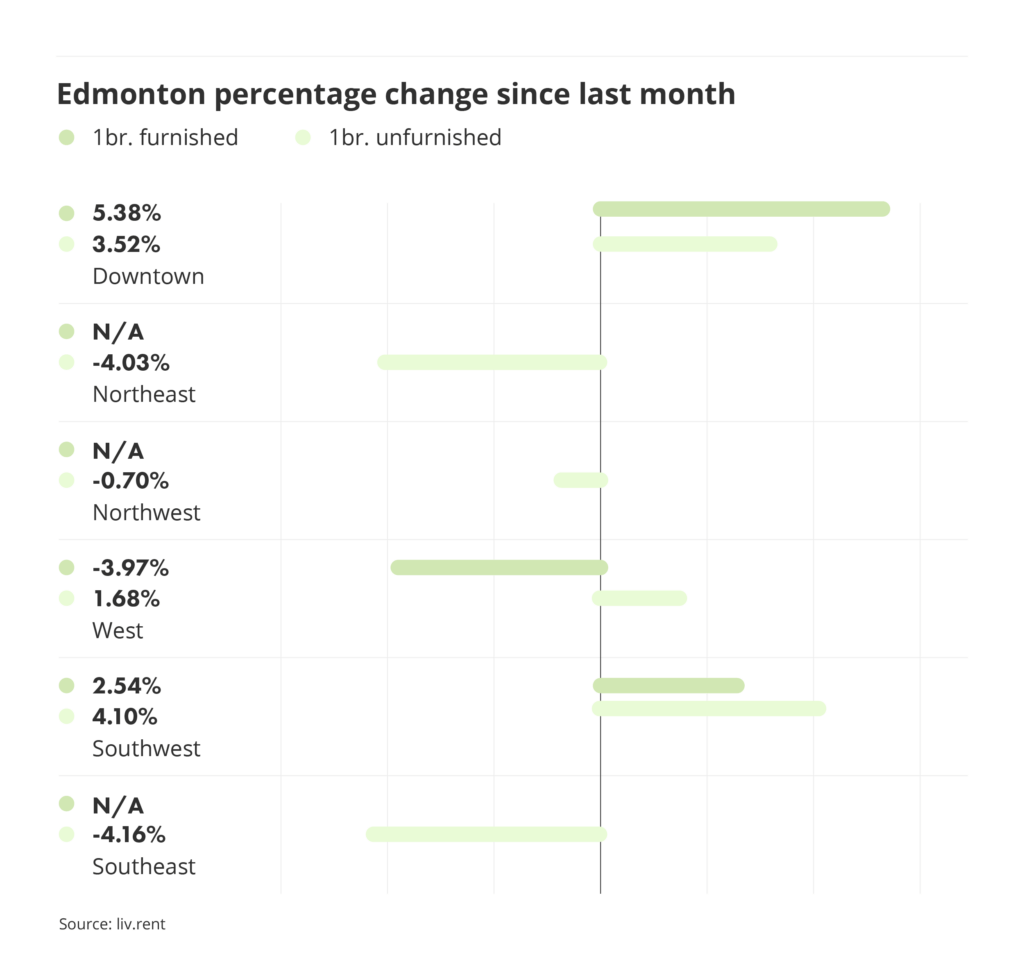

Month-to-month rent change

This chart breaks down the percentage change in rent prices across all of Edmonton’s different sectors between December and January.

This January, there were increases for furnished one-bedroom units in Edmonton including Downtown (5.38%) and Southwest (2.54%). Meanwhile, West Edmonton decreased in price (-3.97%). Prices for unfurnished one-bedroom units in Southwest Edmonton (4.10%) and Downtown Edmonton (3.52%) increased. Prices in both Southeast (-4.16%) and Northeast (-4.03%) Edmonton decreased.

Unfurnished vs furnished rates in Edmonton

In Edmonton, average monthly rent prices for furnished one-bedroom units increased (-0.89%) to $1,454/month, while prices for unfurnished one-bedroom units remained (-0.01%) the same $1,246/month. As of January 2026, furnished units in Edmonton rent for an average of $208 more than unfurnished units. This indicates that landlords who can rent their units furnished would benefit from doing so, particularly on a short-term basis.

Try Premium Landlord Features for free!

Alberta landlords, elevate your rental game with a FREE one-month trial of liv.rent’s Growth plan! Access $68 worth of premium features like Multi-Platform Advertising and Trust Score tenant screening reports with Equifax® credit information.

Looking for our full January 2026 Calgary & Edmonton Rent Report? Download your copy here to get all the latest insights, including a detailed breakdown by neighbourhood.

Quadrant/Sector breakdown

To better understand each of these cities’ average rental prices, let’s break down both Calgary and Edmonton into their constituent quadrants/sectors. We’ll examine prices and trends for one-, two-, and three-bedroom units in each city for a more in-depth analysis.

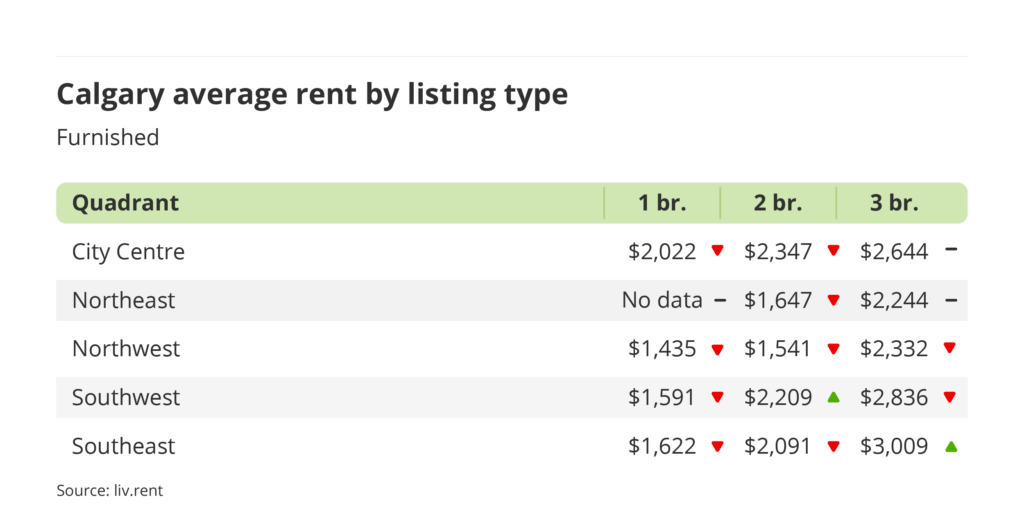

Quadrant breakdown: Calgary

- Prices decreased for all unfurnished one-bedroom units in all quadrants across Calgary except in Southeast.

- All unfurnished three-bedroom units decreased in rental cost across Calgary quadrants except Southwest Calgary.

- Prices increased across all quadrants for unfurnished two-bedroom rental units except in Northwest Calgary. Interestingly, the opposite happened for furnished units, with all furnished two-bedroom units decreasing in price except for Southwest Calgary.

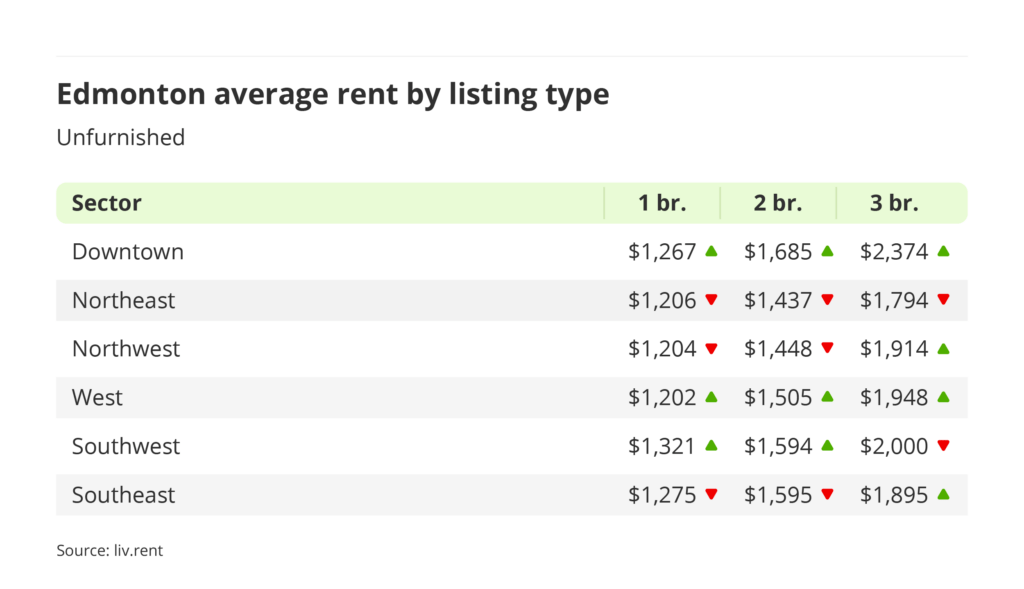

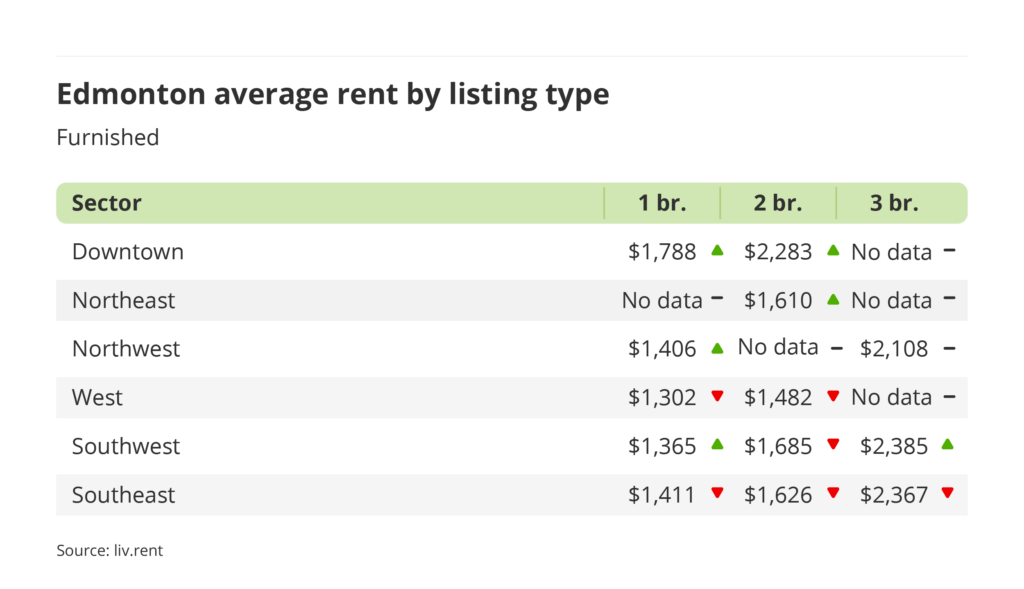

Sector breakdown: Edmonton

- Rents decreased for all unfurnished one-, and two-bedrooms across Edmonton except Downtown, Southwest and West Edmonton.

- Rents for all types of furnished and unfurnished units in Downtown Edmonton increased.

- All unfurnished units increased in price in West Edmonton.

Downloadable resources

Download The Latest Calgary and Edmonton Rent Reports

For the complete Calgary and Edmonton rent reports, download here.

Rental resources for Alberta renters

You can read these comprehensive guides for more information on renting in Alberta and using liv.rent to streamline your rental process.

- FAQ: Landlord & tenant responsibilities in Alberta

- FAQ: Everything you need to know about rent deposits in Alberta

- The Complete User Guide To liv.rent For Landlords & Property Managers

- The Ultimate Renter’s Guide To Using liv.rent

Data collection methodology

Our monthly rent reports use data from our own liv.rent listings, as well as data our team manually collects from other popular listing sites – looking at available basement suites, apartments, condos, townhouses, semi-detached houses, and single-detached houses for each area.

When collecting this data, we do exclude luxury properties listed at over $5,000, as well as rooms for rent and shared accommodation. Investing in manual data collection means that we only consider the current month’s listing, since we can filter out duplicate listings and older ads that haven’t been removed.

Another key difference between our data collection methods and some government agencies like the CMHC is that we only include current asking rent prices. Many official reports will include data for entire buildings in their reports, which tends to skew numbers lower since many units are already occupied, and may be rent-controlled or rented for significantly lower than the current rates.

As we are a Canadian rental platform founded and based in Vancouver, we want to ensure that we’re providing a completely accurate depiction of the rental market in the cities we look at.

Rethink The Way You Rent

Not on liv.rent yet? Experience the ease of digital applications & contracts, verified tenants & landlords, virtual tours and more – all on one platform. Sign up for free or download the app.

Subscribe to receive monthly updates on Canada’s major rental markets. Discover last month’s Rent Reports below:

Vancouver Rent Report

Ontario Rent Report

Montreal Rent Report

Calgary and Edmonton Rent Report

0 Comments