Purchasing real estate is one of the most important financial steps one can take in their lifetime and is always an exciting journey no matter your situation or goals. With its stunning natural landscape and comparatively affordable home prices, buying real estate in Calgary, Edmonton, or another Alberta city is a dream for many Canadians. Whether you’re looking to settle down, switch from renting, or invest in a rental or investment property, understanding the intricacies of Alberta’s real estate market is crucial. In this guide from Canadian all-in-one rental platform liv.rent, we’ll walk you through the essential steps, from preparation to final purchase, and provide insights that will allow potential homebuyers to make informed decisions every step of the way.

Try Premium Landlord Features for free!

Alberta landlords, elevate your rental game with a FREE one-month trial of liv.rent’s Growth plan! Access $68 worth of premium features like Multi-Platform Advertising and Trust Score tenant screening reports with Equifax® credit information.

What you need to purchase a home

Purchasing a home is a huge financial commitment and requires prospective buyers to make some preparations in advance. Before diving into the real estate market, it’s important to ensure that you’re financially and logistically ready. Here are key steps to consider:

- Financial Readiness: Assess your financial health by examining your savings, income, and credit score. Most lenders require a down payment of at least 5% of the home’s purchase price for a conventional mortgage. Additionally, homebuyers should budget for closing costs, which typically range from 1.5% to 4% of the home’s price.

- Documentation: Gather necessary documents, including proof of income (pay stubs, tax returns), bank statements, and identification. These will be needed for mortgage applications and other financial assessments.

- A real estate agent: Engaging a knowledgeable realtor can simplify the buying process. They offer valuable market insights, negotiate on your behalf, and help you navigate legalities. Choose a realtor with experience buying real estate in Alberta for the best results.

How to buy real estate in Alberta

Regardless of where in Canada you are, buying a home typically involves the same key steps, though some things, such as down payment assistance programs, will differ slightly in Alberta. Following this rough guideline and listening to the advice of a real estate professional is crucial to ensure a smooth and successful transaction

1. Deciding on your goals

When buying real estate in Alberta, it’s important to first decide exactly what you’re looking for in a home. Will you be living in the space or is this a rental property? How many bedrooms do you need? These are important questions to help narrow down your search.

2. Saving for a down payment

Once you have a clear idea of the type of property you’re interested in, you can calculate how much you’ll need to have for a down payment and plan accordingly.

It’s also important to figure out whether you want to plan for a high-ratio mortgage (less than 20% down payment) or a conventional mortgage (more than 20% down payment). While the former requires less savings upfront, you’ll face higher interest costs and CMHC fees as a result.

3. Building credit

Having a solid credit score and good income stability is essential for getting approved for a mortgage.

It’s generally accepted that you need a credit score of at least 640 to get approved for a mortgage, though this depends on your other finances and can vary depending on the lender. Having a stable income is also key to succeeding in mortgage approval.

4. Morgage Pre-approval

Getting pre-approved for a mortgage is generally one of the the first steps in a homebuying journey. This helps you understand your budget and shows sellers that you are a serious buyer.

5. House hunting

With your realtor’s assistance, begin your search. Focus on properties that meet your criteria and budget and if you plan on renting out your new property, be sure to consider potential rent prices in the area to evaluate whether you can earn a consistent profit.

6. Making an offer

Once you find the right home, your realtor will help you make a competitive offer. Be prepared for negotiations with the seller.

7. Home inspection

After your offer is accepted, conduct a home inspection to identify any potential issues. This step can save you from unexpected repair costs down the line.

This is similar to the process for inspecting a rental property, although there is often a licensed home inspector present and the process is much more thorough due to the significant financial stake.

Unlock Exclusive Monthly Insights

Download the full Calgary and Edmonton report for more expert insights and in-depth data for average rent prices, market trends, and neighbourhood comparisons.

8. Closing the deal

Once everything is in order, all that’s left is to finalize your mortgage and complete the closing paperwork. Your realtor and lawyer will guide you through this process to ensure everything is in order.

Renting vs. buying: which is right for you?

Many prospective homebuyers looking into buying real estate in Alberta will already be renting in the province and are looking to find something more permanent while building equity.

While purchasing a home may seem like an easy decision if you’re financially prepared, deciding whether to rent or buy requires careful consideration influenced by various factors:

- Financial Considerations: Buying a home typically requires a larger initial investment compared to renting. However, owning property can be a valuable long-term investment with the potential for appreciation.

- Flexibility: Renting offers more flexibility, allowing you to relocate with ease. Buying, on the other hand, provides stability and the freedom to personalize your space.

- Market Conditions: In Alberta, market conditions can vary. In a buyer’s market, purchasing may offer better value. Conversely, in a seller’s market, renting might be a more prudent choice until conditions improve.

>> Recommended Reading: Renting vs. buying a house: Which is right for you?

Where to buy real estate in Alberta

Choosing the right location is crucial for both lifestyle and investment potential. While most people looking into buying real estate in Alberta already have an idea of where they’d like to own a home, it’s important to consider these factors when deciding where to buy:

- Larger Cities vs. Smaller Towns: Larger cities like Calgary and Edmonton offer diverse employment opportunities, amenities, and a dynamic real estate market. Smaller towns, while quieter, often provide more affordable housing and a close-knit community feel.

- Neighbourhood Considerations: Research neighbourhoods based on factors like proximity to schools, public transit, and recreational facilities. Safety, future development plans, and community vibe are also important considerations.

- Market Trends: Stay informed about market trends in different areas. Some neighbourhoods might be up-and-coming with great investment potential, while others may be well-established but more expensive.

If you’re considering renting out your property, it’s also important to keep an eye on rent prices in different Alberta cities to see where you can make the highest return on your investment.

>> Recommended Reading: The 8 cheapest places to live & rent in Alberta

How to rent out your home in Alberta

One of the most popular reasons to purchase a home is to own a rental property. Rent prices in major Alberta cities like Calgary and Edmonton have risen substantially in recent years, making this a lucrative time to enter the rental market.

If you plan to generate rental income from your new real estate purchase in Alberta, you’re first going to need to find tenants. It’s important to be diligent throughout the rental process and ensure you’re finding the best tenants possible. The last thing you want is for tenants to damage your new home, so being thorough while screening applicants is key.

This is where liv.rent comes in. This Vancouver-based rental platform was designed to help landlords save time and find the right renters faster with all-in-one solutions for everything from listing to signing a lease.

Here are some tips on how you can streamline the most important and time-consuming parts of the rental process and ensure you’re doing your due diligence in your search for the perfect tenants.

Tip #1: Share your listing to reach more renters

The best way to speed up your rental process from the get-go is to share your listing to as many platforms as possible. It’s tough to get your unit rented in a timely fashion if you don’t have enough leads, and being able to reach renters on a variety of sites is key to achieving this.

Once your listing has been posted on liv.rent, landlords can easily share it to popular platforms like Craigslist, Kijiji, and Facebook Marketplace, expanding your audience significantly and ensuring that you receive plenty of applications.

Neo World Elite Mastercard

Looking for premium rewards on everyday essentials? The Neo World Elite® Mastercard offers up to 5% cashback on gas and groceries, plus exclusive travel benefits like Extended Warranty and Auto Rental Collision Loss coverage. With the potential to earn over $1,200 in cashback annually, it’s designed to elevate your spending power. Click here to find out more!

Tip #2: Have a centralized “hub” for your listing

Now that you’ve got more applications than you know what to do with, it’s time to streamline things to help save time later on. Within each pre-formatted listing you share, there’s a link for interested renters to apply directly on liv.rent. One of the most time-consuming parts of the rental process is having to read through emails and messages from all different platforms to pick out the renters that you’re interested in continuing the conversation with.

By keeping all your communications limited to one convenient platform, you’re cutting down on the time this step typically takes significantly.

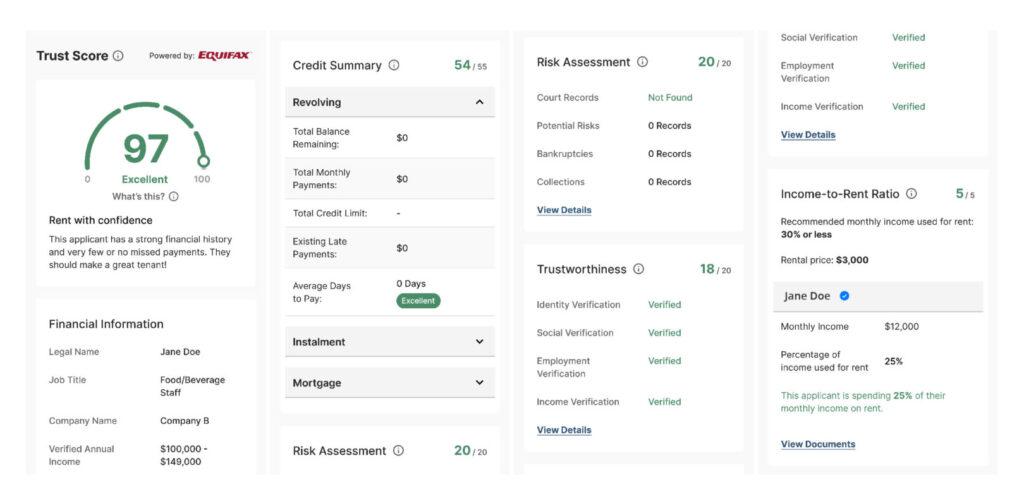

Tip #3: Go beyond a credit check

The single most important part of the rental process for laneway home landlords in particular is tenant screening.

It’s more important than ever to make sure that your new tenants are not only able to pay rent, but won’t cause any disturbances to their neighbours. Your promising new investment can quickly become a liability with tenants who interrupt your routines or worse – cause damage to your brand-new laneway house. It’s normal for landlords to perform a credit check on applicants to get a sense of their financial situation and ability to pay rent on time, but this doesn’t always tell the whole story.

This is why liv.rent developed the Trust Score – our comprehensive tenant screening tool. Using credit information from Equifax® and our own industry-leading verification features, this report combines all the information landlords need to identify the right renters quickly. An easy-to-understand score provides an easy way to assess and rank applicants, while information like a detailed risk assessment, income-to-rent ratio, and a unique trustworthiness metric help give you a full picture of applicants, even if they don’t yet have a Canadian credit history.

>> Recommended Reading: Landlord guide: renting out your house with a mortgage

Resources for Alberta homebuyers

Here are some resources from liv.rent and trusted government sources to help you navigate the homebuying and renting process in Alberta:

- The latest liv.rent Calgary & Edmonton Rent Report

- Guides to Alberta cities and neighbourhoods

- Alberta Rental Law information

- Alberta Real Estate Association (AREA): Offers valuable market reports and resources for buyers.

- Canada Mortgage and Housing Corporation (CMHC): Provides mortgage calculators, affordability tools, and homebuying guides.

Rethink The Way You Rent

Not on liv.rent yet? Experience the ease of digital applications & contracts, verified tenants & landlords, virtual tours and more – all on one platform. Sign up for free or download the app.

Subscribe to receive the latest tenant & landlord tips and get notified about changes in the Canadian rental market.

>> Stay up-to-date on the average rent in Vancouver, Toronto and Montreal: Rent Reports.

0 Comments