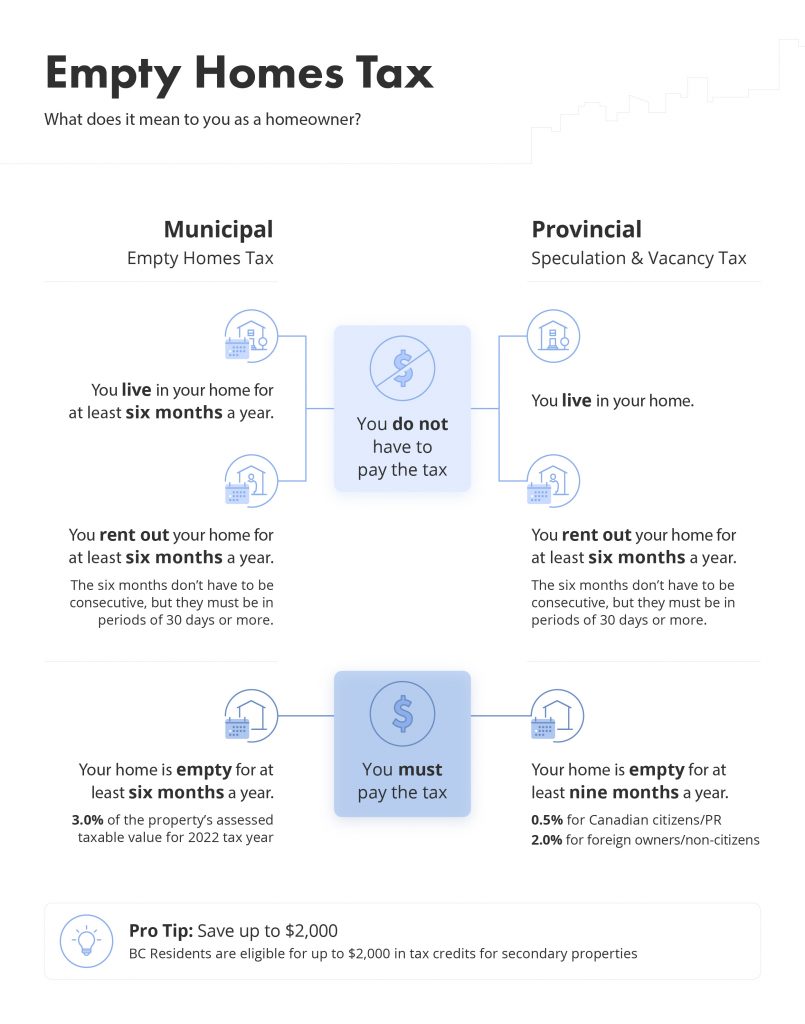

B.C. and Vancouver each have their own taxes for homeowners not occupying or renting their residences. In B.C., there is a province-wide tax called the “Speculation and Vacancy Tax”, and Vancouver has its own specific “Empty Homes Tax”. These were originally brought in with the goal of targeting vacant properties, increasing vacancy rates and creating more affordable housing throughout the province.

The government’s goal is to turn under-utilized properties into homes for people living and working in B.C. And people who own property in Vancouver also have a civic tax to pay for similar reasons. We’re liv.rent, an all-in-one rental solution, and we created a quick guide to the Empty Homes Tax to help you navigate: Because the implementation of these taxes can be confusing, This quick guide will show you everything you need to know about being taxed on an empty property in B.C.:

Join Our Newsletter

For more info on rental laws and policies (e.g. eviction, lease agreements, repairs & maintenance), subscribe to get the latest news.

What is the municipal Empty Homes Tax?

Vancouver’s municipal Empty Homes Tax was designed to prevent people from price-fixing and inflating the rental market to an unreasonable price.

Vancouver homeowners are required to declare their property’s occupancy status on or before February 2, 2024 for the 2023 reference year.

If you do not declare, your property could be deemed vacant. That means you would have to pay a $250 fine (for failing to declare) and then you’ll also be subject to the municipal Vacancy Tax. For the reference year 2023, This will be 3.0% of the assessed taxable value of your property.

April 15, 2023, is the last day to pay any outstanding 2023 Empty Homes Tax.

What is the B.C. Speculation and Vacancy Tax?

The provincial Speculation and Vacancy Tax was created by the B.C. government with the aim of helping to turn any empty homes in the region into occupied homes — increasing the housing supply while discouraging housing prices from going up too unsustainably fast.

It doesn’t affect 99% of British Columbians who use their home as their primary or “principal” residence, but for those whose homes are empty for more than 9 months of the year, taxation rates may apply. For the reference year 2023, this rate is 0.5% for Canadian citizens and permanent residents, and 2.0% for foreign owners and non-citizens.

How is Principal Residence defined?

A principal residence is the place where you make your home, live your life and pay your bills.

For the purposes of the Vacancy Tax, an owner can only have one principal residence and, if asked to verify their claim through an audit, you will have to provide acceptable evidence like your Income tax returns and driver’s licence or other pieces of identification.

Am I exempt from these taxes?

If your home is listed as your principal residence and it is unoccupied for more than six months by you, your family or a tenant — then yes, your home will be taxed.

Most British Columbians are exempt from both of these taxes, meaning:

- You as the owner, or a family member or friend, or other permitted occupier makes the property their principal residence for at least six months of the tax year.

- The property is rented for residential purposes for at least six months of the current year in periods of 30 or more consecutive days.

What amount will I be taxed if I am not exempt?

Provincially, the speculation and vacancy tax rate varies depending on you, the owner’s, tax residency and whether you are a Canadian citizen or permanent resident, or a member of a satellite family.

It will be levied on owners who own the property on December 31 of each taxation year and the highest tax rate will be levied on those with the most limited social and economic ties to B.C. like foreign owners and satellite families.

Currently, the taxes are levied at:

- The provincial Vacancy and Speculation tax is 2% for foreign owners and satellite families, and 0.5% for British Columbians and other Canadian citizens or permanent residents who are not members of a satellite family.

- The civic Empty Home Tax will be 3.0% of a property’s assessed taxable value for the 2023 tax year.

Will I have to pay both taxes?

If you own residential property in Greater Vancouver (as defined in Section 1.2, of the Vacancy tax by-law), and your property is empty for more than six months for the Empty Homes Tax, and nine months for the Speculation and Vacancy Tax, then yes, you may have to pay both taxes.

Read more: Homeowner’s Guide to B.C. Taxes: Property Tax, Empty Homes & Speculation Tax, GST and PST

Can you legally avoid the empty homes tax?

You can avoid paying the empty homes tax easily by renting out your property. This is precisely why the tax was designed and will earn you additional income.

If you are a new or inexperienced landlord, it may seem like a daunting venture but it doesn’t have to be. The liv.rent app, for example, makes it easy to rent and manage your properties directly anywhere, anytime.

Create a landlord profile, upload your property details, find verified tenants and invite them to submit an application or wait for them to express interest or to apply to rent your vacant property. You can issue tenancy applications and collect rent through the app too, making it 100% digital and contactless.

How do I submit my property declaration and payment?

You will have to declare your property status to the province and to the city if applicable.

The province will send you a speculation and vacancy tax declaration letter in the mail by mid-February listing all the residential properties you own and outline how to complete your declaration and claim applicable exemptions. It must be completed by March 31 each year, regardless of whether you are eligible for an exemption or not.

In Greater Vancouver each year, every property owner must submit a property status declaration to determine if you are subject to the Empty Homes Tax. If you fail to declare your residential property status by February 2, 2024, the tax will be applied. Payments are due April 15, 2023. You can submit your declaration online.

Read more: Top 10 Tax Deductions for B.C. Landlords

Read more: Toronto’s 9 Best Apartment Rental Websites

Additional resources for landlords

- Learn more about becoming a landlord on liv.rent

- First Time Landlord Checklist for a step-by-step guide to renting out your property

- Vancouver’s Empty Home Tax Explained

- The Government of B.C.’s Speculation and Vacancy Tax

- The City of Vancouver’s Municipal Empty Homes Tax

Rethink The Way You Rent

Not on liv.rent yet? Experience the ease of digital applications & contracts, verified tenants & landlords, virtual tours and more – all on one platform. Sign up for free or download the app.

Subscribe to receive the latest tenant & landlord tips and get notified about changes in the Canadian rental market.

>> Stay up-to-date on the average rent in Vancouver, Toronto and Montreal: Rent Reports.

Great Article the empty homes tax how to avoid