For homeowners and landlords, the cost of ownership extends far beyond the price paid for a property. It may include maintenance, repair and renovation costs but it always includes a variety of federal, provincial and municipal taxes. B.C.’s taxation system is unique for a few reasons, and can often confuse newer homeowners. In this guide, which has been updated in time for the 2024 property tax deadline, we’ll highlight all the taxes B.C. homeowners need to keep in mind, including the BC property tax, Empty Homes Tax, and more.

Download The Landlord’s Guide To Property Tax Deductions

The ultimate tax guide for landlords in Canada. Everything you need to know about taxes, and how to get a bigger return.

Goods and Service Tax (GST)

(ONE TIME PAYMENT)

The federal Goods and Services tax (GST) is charged on all new properties. It is 5% of the purchase price. A GST New Housing rebate of up to 36% of the original GST paid, is available for new homes up to $350,000 and a partial rebate is available for homes up to $450,000. However, given Vancouver real estate prices, these rebates are rarely applicable.

Keep in mind, the GST tax will also be charged on services typically associated with a purchase like appraisal and inspection fees, lawyers, notary publics and realtors.

Provincial Sales Tax (PST)

You do not have to pay B.C.’s provincial sales tax of 7% on the purchase of a property. This includes strata units.

Property Transfer Tax

(ONE TIME PAYMENT)

Once you purchase a property, you will need to pay a one-time provincial Property Transfer Tax (PTT). The payment is charged at a rate of 1% on the first $200,000 of the purchase price and 2% on the remainder up to and including $2 million. The PTT is 3% on amounts greater than $2 million. If the property is residential, a further 2% PTT is payable on the portion greater than $3 million. Refer to the PTT calculator for an accurate figure.

If you are a first-time home buyer, you may be exempt from paying the PTT if the home is less than $500,000. There is also a proportional exemption for homes priced up to $525,000. Over that amount, the regular PTT calculations will apply.

For other qualifying buyers of new homes, there may be an exemption if the purchase price of the home is less than $750,000. And again, there’s a proportional exemption for homes in the following range of $750,000-800,000.

>> Recommended Reading: Top 10 Tax Deductions for B.C. Landlords

BC Property Tax

(ANNUAL PAYMENT)

Every property owner in British Columbia is subject to property taxes which are calculated on the municipal level based on your property’s valuation and thus, vary from place to place. The money collected by your city goes to fund many of the essential services we depend on for a safe community including the police, fire fighting, waste and sewage management, a school tax, clean water, and emergency rescue.

They also fund the recreation and community centres, libraries, parks, and services and support programs which play an integral role in ensuring the vibrancy and livability of our neighbourhoods. These different taxes, such as school taxes, are included in your annual BC property tax assessment.

Property tax rates determine how much property tax you pay and are based on the assessed value of your property. Refer to the B.C. Assessment website and enter your address for an accurate value. The tax rate applies to each $1,000 of the net taxable value and may differ based on the class of property you own.

In Vancouver, annual property tax payments are due twice a year — called advance taxes and main taxes. For 2024, advance taxes are due February 2 and main taxes are due July 3.

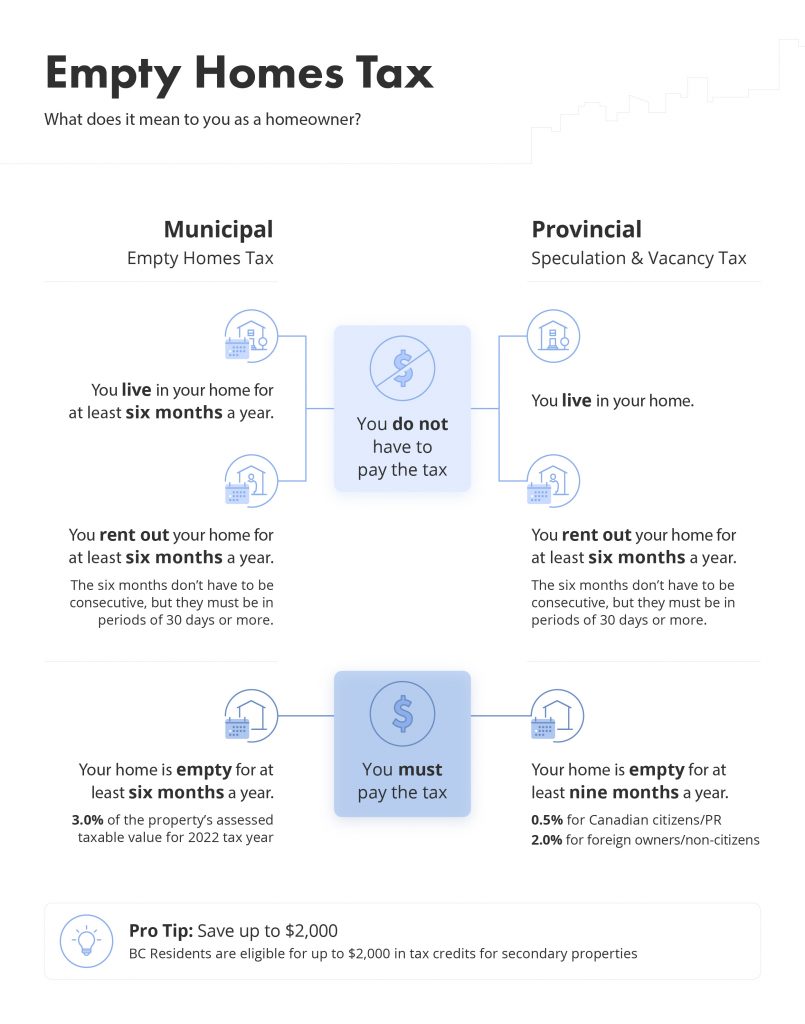

Vancouver Empty Homes Tax

(ANNUAL PAYMENT)

The Vancouver Empty Homes Tax was instituted to target vacant properties, increase vacancy rates and create affordable, rental housing for people who live and work in Vancouver.

For 2024, owners must have annually declared by February 2 whether their property is occupied for at least six months of the year to be exempt from this tax. Then, any outstanding payments are due by July 3.

>> Recommended Reading: [Updated For 2024] What Is The Empty Homes Tax?

B.C. Speculation and Vacancy Tax

(ANNUAL PAYMENT)

The provincial Speculation and Vacancy tax is an annual tax based on how owners use residential properties in B.C.’s major urban areas. Coupled with the Vancouver Empty Homes Tax, both are designed to help combat skyrocketing house prices in various regions and the limited rental supply by encouraging owners, who do not occupy their properties, to place them on the rental market to provide housing for people who live and work in the area.

>> Recommended Reading: Vancouver’s Empty Home Tax Explained

The tax is charged as follows:

- 2% for foreign owners and satellite families.

- 0.5% for Canadian citizens or permanent residents of Canada who are not members of a satellite family.

Like the Empty Homes Tax, the onus is on owners to annually declare their residency status and whether their property is occupied for at least 6 months of the year to qualify for an exemption from this tax.

Taxation Example

Below we’ve run through a taxation example on a $1.5 million property in Vancouver. Property taxes must always be paid and, depending on your circumstances, these others may also be applicable:

| TYPE OF TAX | RATE | CALCULATED PAYMENT |

| GST (if brand new otherwise n/a) | 5% | $75,000 |

| Property Transfer Tax (first $200,000) | 1% | $2,000 |

| Property Transfer Tax (remaining portion) | 2% | $26,000 |

| Empty Homes Tax (if empty for <6 months)* | 3% for 2023 | $18,750 |

| Speculation and Vacancy Tax for Canadian Citizens (if empty for <6 months)* | 0.5% | $7,500 |

| Speculation and Vacancy Tax for foreign owners & satellite families (if empty for <6 months)* | 2% | $30,000 |

| Property Tax* | 0.278070% | $4,171 |

*These taxes and the equation for calculating them are based on the B.C. Assessed Value of a property, not the purchase price. Refer to the B.C. Assessment website and enter your address for an accurate value.

Property tax rates by city in the Lower Mainland

| City | Property Tax Rate |

| Vancouver | 0.278070% |

| Burnaby | 0.272340% |

| Richmond | 0.291046% |

| North Vancouver | 0.280539% |

| Delta | 0.327250% |

| Surrey | 0.275718% |

| Coquitlam | 0.313280% |

| New Westminster | 0.388587% |

Source: wowa.ca

Though these are considerable costs, there are ways to save. Be sure to investigate the government incentives and rebates available to you which will help to offset the money you’ve paid in taxes. Check out this guide to Grants and Rebates for buyers, owners and renters.

Rethink The Way You Rent

Not on liv.rent yet? Experience the ease of digital applications & contracts, verified tenants & landlords, virtual tours and more – all on one platform. Sign up for free or download the app.

Subscribe to receive the latest tenant & landlord tips and get notified about changes in the Canadian rental market.

>> Stay up-to-date on the average rent in Vancouver, Toronto and Montreal: Rent Reports.

0 Comments