It’s tax time once again, and if you’re a landlord, you might have a lot on your plate for the 2024 tax year. But don’t worry — to help clear up tax confusion, liv.rent was joined by Natalija Andronikova, a Senior Tax Expert at TurboTax®, for a live liv.talk webinar that’s essentially a Canadian landlord’s how-to guide to property tax deductions. This post is a partial transition of that webinar, and we’ll be going over basic tax principles, tax tips for getting a bigger return, and what’s new for the 2025 tax filing season.

Introduction: Rental property tax deductions in Canada

Download The Landlord’s Guide To Property Tax Deductions

The ultimate tax guide for landlords in Canada. Everything you need to know about taxes, and how to get a bigger return.

Video transcription

This article is a partial transcription from our liv.talk live webinar: Landlord’s Guide To Tax Deductions featuring TurboTax Canada. Watch the video above and download the guide now to hear all of our insights that landlords and investors need to know to be ready for their 2025 tax filing.

Each landlord has a unique tax position and at the end of the day, it’s your responsibility to follow the rules set out by the Canada Revenue Agency (CRA) and we encourage landlords to keep up with the CRA for the latest news and updates.

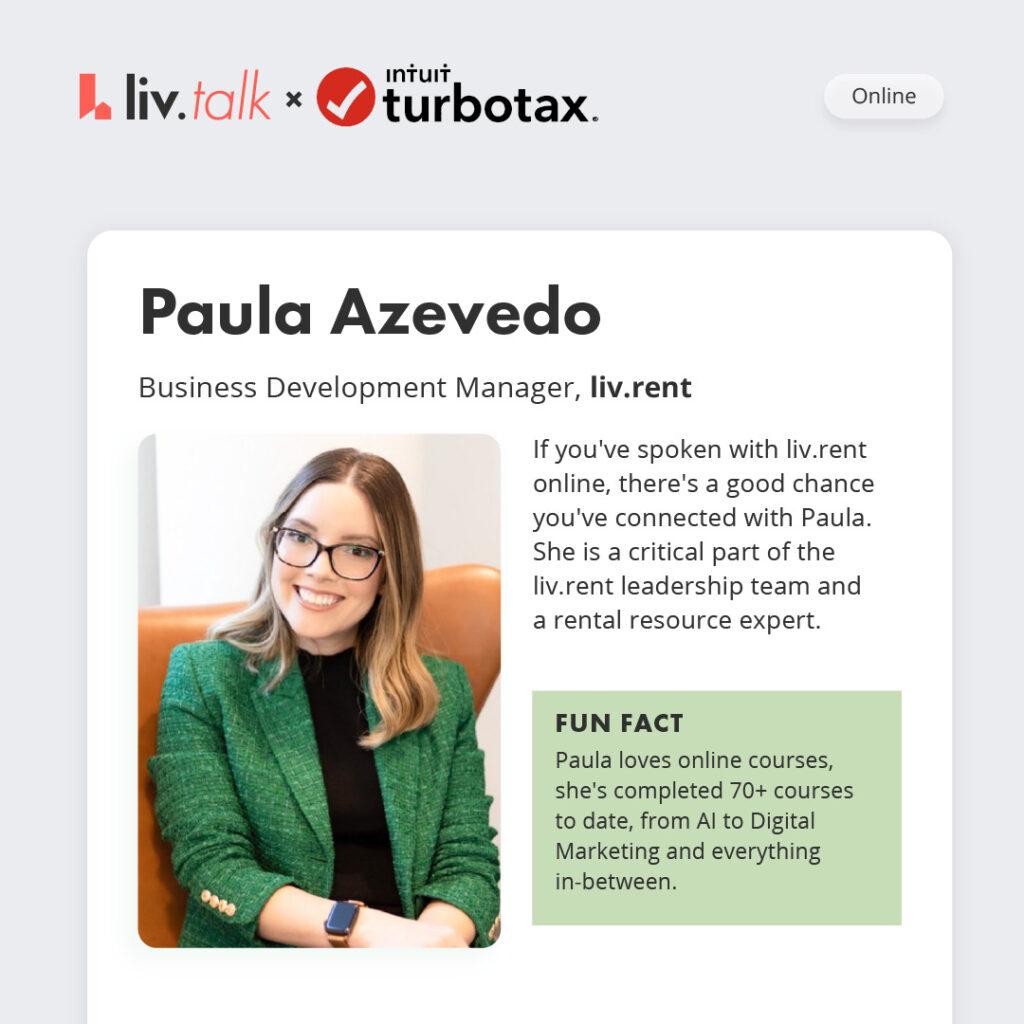

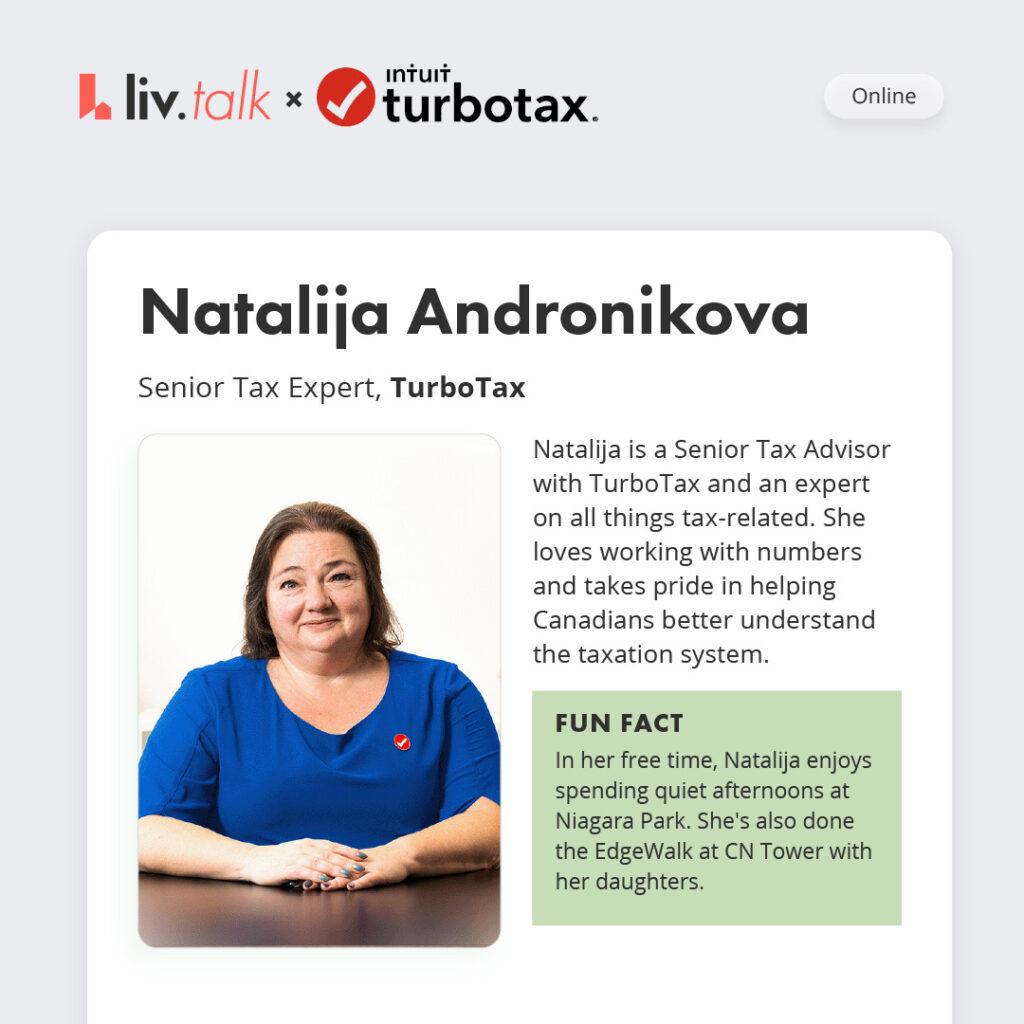

Meet our webinar leaders: liv.rent’s Business Development Manager Paula Azevedo was joined by Natalija Andronikova, Senior Tax Expert at TurboTax.

1. Tax 101: basic tax principles for landlords

When it comes to filing taxes, you have to get the basics down first. This section of the webinar is like a tax 101 class for landlords. We cover:

- An overview of filing taxes as a landlord

- Rental income vs. business income

- Share of ownership

1. Filing taxes as a landlord

Natalija gives her advice on what rental property owners should do to prepare for their tax filing. Her advice is to be:

- Organized – make sure to organize all your files in a secure place

- Professional – separate your personal purchases from your rental purchases

- Accurate – remember to keep all itemized receipts to verify the nature of the expense

2. Rental income vs. business income

It’s important to know whether the money you’re getting from your property can be classified as rental income or business income.

- rental income is when you provide housing

- business income is when you provide not just housing, but also other services

3. Share of ownership

In Canada, share of ownership is when you don’t fully own a rental property individually. Most typically, it would be split 50/50 between spouses or family members, for example.

Or, if you own it 100% on your own, then you would claim all the income as your own.

How to claim work from home expenses

Landlords will want to take advantage of the home office expense this year if they continued to work from home in 2024.

The home office expense is available to anyone who worked from home for at least half of the time over a consecutive period of four weeks or more because of the pandemic.

There are two versions of processes: a simplified process and a traditional, more detailed process.

1. Simplified process

As part of the simplified process, people can claim up to $2 per day up to a maximum of $500. This would cover a range of expenses you had because you were stuck working at home.

2. Traditional detailed process

Landlords will want to try to go for this more traditional detailed process because it can add up to more than $500 in tax relief. To file with this process, you will need a T2200 from your employer, plus you’ll want to figure out the square footage of both your home and your office.

Things that can be covered by this process include:

| Some bills & utilities | Maintenance | Office supplies | Cell phone (for employment use) |

| – rent – internet – electricity – heat – water | – minor repairs – cleaning supplies – light bulbs paint | – stationery items – pens – folders – sticky notes – postage – toner – ink cartridges | – basic cell service plan for work use – any long-distance calls for work |

2. Tax tips for property owners – how to get a bigger return

At the end of the day, everyone, including landlords, wants to make sure they’re getting the best return possible.

There are six key areas where you can help yourself to maximize your return:

- Claimable expenses

- Mortgage payments

- Common expenses that people tend to overlook or forget

- Current expenses vs. capital expenses

- Claiming a loss

- Bookkeeping and tax tips

1. Claimable expenses

There are many expenses that landlords and property owners incur that they will want to claim for a better return. This can include things like insurance and interest costs. Additionally, some repairs or routine maintenance you do on your property can be claimable.

Plus, if you obtain professional services, that can also be a claimable expense. Finally, keep those receipts for any trips to Staples because you can also claim office supplies.

2. Mortgage payments

You cannot deduct your mortgage payment.

However, you are eligible to claim any interest that you incurred on money that was borrowed to maintain the investment. Any interest on your mortgage, line of credit, or any other loan for your investment property can be claimed.

We cover this at length in the third section of the live event in our discussion of rising interest & mortgage rates.

3. Common expenses that landlords overlook

Natalija shared some hidden expenses that people often forget to claim even though they’re eligible for them. This will include things like:

- Insurance

- Interest on mortgage payments

- Professional services

- Office supplies

- Repairs and maintenance

- Utilities

Additionally, from the perspective of investment analysis and financial planning, the most common costs that investors forget to include when they are looking at properties as income properties are:

- Vacancy

- Property management

- Capital expenditures

4. Current expenses vs. capital expenses

Natalija covers the difference between current and capital expenses. Here’s a brief overview of what was covered:

Essentially, current expenses are day-to-day costs that keep your property reasonably maintained.

This includes things like:

- Fixing a broken sink

- Painting a fence

- Replacing a lightbulb

However, capital costs, are expenses that go beyond that. They actually add considerable value to your property. This includes things like repairs that extend the useful life of your property, improve it beyond its original condition, or any repairs made in advance of selling a property or as a condition of a sale.

5. Claiming a loss

So, how can you claim a loss if your rental expenses were more than your rental income? Natalija covers that in our webinar.

Essentially, when you’re filling out your T776, your tax-filing software will automatically calculate this for you. Since your rental property is meant to be generating income, you may need to provide additional documentation to explain why you saw a loss.

6. Bookkeeping and tax tips

Bookkeeping is one area where people can help themselves greatly to make tax season go more smoothly, saving them time and energy.

Natalija recommends sticking to either digital or paper when keeping track of your income and expenses, as trying to do both will only cause confusion.

She also recommends getting an email address for each of your properties, marking one day a month in your calendar as a bookkeeping catch-up day, and anywhere you can automate processes like income and expenses.

We made organized solutions for every step of the rental process.

For example, instead of checking emails, texts, and voicemails — you can keep all communication between you and tenants in the app. Our chat timeline feature is also where you send contracts to sign as well so it’s all there for you securely stored you don’t have to print, file, and chase down lost emails.

3. What’s new for the 2024 tax filing season

In the final section of our webinar, Paula and Natalija break down all the important changes landlords should be aware of for 2024.

1. Rising interest rates

Natalija discusses the impact of rising mortgage rates on rental property owners, specifically how they can deduct their higher mortgage interest on their tax returns.

The exact amount of interest you can claim depends on how much of your rental property is used to generate income, and for how much of the year it’s rented.

- If your entire property is rented for the entire year, you can claim 100% of your mortgage interest

- If only part of your property is rented, or you only rent it for part of the year, you’ll need to calculate your deductible interest.

- For example, say you’re renting out 500 square feet in a 2,000 square foot home for a total of six months of the year.

- In this case, you could claim 12.5% of your mortgage interest.

- This was broken down in more detail during the event.

2. Deadline for filing

The deadline to file taxes and pay an amount owing for individuals is April 30th this year.

FAQ: Rental property tax deductions in Canada

Are there any special tax deductions for rental properties in Canada?

Yes, there are special tax deductions available for rental properties in Canada. These deductions are designed to help reduce the amount of tax you pay on income earned from rental properties.

The deductions may include expenses such as mortgage interest, property taxes, insurance premiums, repairs and maintenance, legal fees, and other related costs. It’s important to note that these deductions are only available to those who own and rent out their properties, and not to those who simply own rental properties.

Additionally, the exact amount of the deductions may vary depending on the province in which the rental property is located. To learn more about the specific deductions available in your province, it’s best to consult a qualified tax professional.

What rental property tax deductions are available in Canada?

Rental property owners in Canada can take advantage of several tax deductions when filing their taxes. These deductions can help reduce the amount of taxes owed and can include expenses related to the rental property such as mortgage interest, property taxes, insurance, repairs and maintenance, and utilities.

Other deductions may also be available depending on the type of rental property and the province in which it is located. For example, in some provinces, landlords may be able to deduct the cost of advertising for tenants, as well as the cost of travel to inspect the property. Landlords may also be able to deduct a portion of their home office expenses if they use a portion of their home for rental business activities. It is important to consult with a tax professional to determine which deductions are available in your province.

Can you deduct legal fees and professional fees associated with your rental property?

Professional fees or legal fees that you incur from preparing leases or collecting overdue rent are tax deductible in Canada.

Legal fees associated with purchasing real estate cannot be deducted, however.

How can I maximize my rental property tax deductions in Canada?

First, you should make sure you are taking advantage of all the deductions available to you as a landlord. These include deductions for repairs and maintenance, insurance premiums, legal and accounting fees, and other expenses related to your rental property. You can also deduct the cost of any capital improvements you make to the property, such as new appliances or a new roof.

Second, you should make sure you are taking advantage of any tax credits or deductions that are available to you. These can include deductions for energy-efficient improvements, such as new windows or insulation, or deductions for investments in rental property.

Finally, you should keep track of all your expenses related to your rental property. This will help you maximize your deductions and ensure you are taking advantage of all the deductions available to you.

Is any type of mortgage interest incurred on a residential rental property tax deductible?

You can claim Mortgage Interest on the money you borrow to buy or improve your rental property. To do so you can claim the deduction on the T776 – Statement of Real Estate Rentals form. To be clear, you can only claim the interest portion and not the principal payment as an expense.

This post from TurboTax has more information on claiming mortgage interest.

What happens if you lose a receipt for an expense you plan on claiming?

Whenever you are claiming an expense or deduction, you should have the actual receipt available prior to filing in the event the Canada Revenue Agency (CRA) requests the documents to support that claim. If the receipt is lost or not available, and you are requested to submit documents backing up this claim, not having an actual receipt might result in the loss of that deduction.

Can I claim unclaimed expenses from previous years (e.g. vacancy expenses) in the present tax year?

If you neglected to claim an expense or deduction in previous years, you must make an “Adjustment” to that particular tax year. Be sure you have your supporting documents available as CRA will likely request proof.

Is liv.rent tax deductible?

Yes! Property management expenses can include subscriptions for software. If you’re on liv.rent’s Growth or Business plans, you can claim your subscription fees as an Operating Expense as it is a web-based property management service.

About TurboTax Canada

TurboTax® is Canada’s #1 tax preparation software to file taxes online. No matter your tax situation, TurboTax® has you covered. Prepare and file your taxes online securely with 100% accuracy.

Rethink The Way You Rent

Not on liv.rent yet? Experience the ease of digital applications & contracts, verified tenants & landlords, virtual tours and more – all on one platform. Sign up for free or download the app.

Subscribe to receive the latest tenant & landlord tips and get notified about changes in the Canadian rental market.

>> Stay up-to-date on the average rent in Vancouver, Toronto and Montreal: Rent Reports.

0 Comments