Purchasing a rental property can be a fantastic way to gain financial stability in the long term and can offer some great tax benefits. Once you have already been through the process of buying your first unit getting a second mortgage should be fairly straightforward. There are still a few crucial things that you need to consider. This guide from liv.rent will take you through everything you need to know when purchasing a rental property in Canada.

Landlords & Property Managers

Advertise your rental for free on liv.rent – an all-in-one rental platform.

What to know before buying a rental property?

Jumping into the world of rental properties can be daunting if you don’t know what to look for. There is more to buying a rental property than you might think, from buying at the right time to making sure you get the financing right as well as realizing the tax benefits. This section breaks down the top three things you need to know when purchasing your first rental property in Canada.

1. Is it a good time for you to buy a property?

It’s important to look at your current financial standing to see if you can afford a property. Can you still cover your existing financial obligations long term, will you be able to cover closing costs, is your credit in good standing but most importantly do you have the 20% down payment to get started? It’s crucial to take a step back and consider all potential future costs and how they will impact you before committing to purchasing a property, waiting until the time is right could save you in the long run.

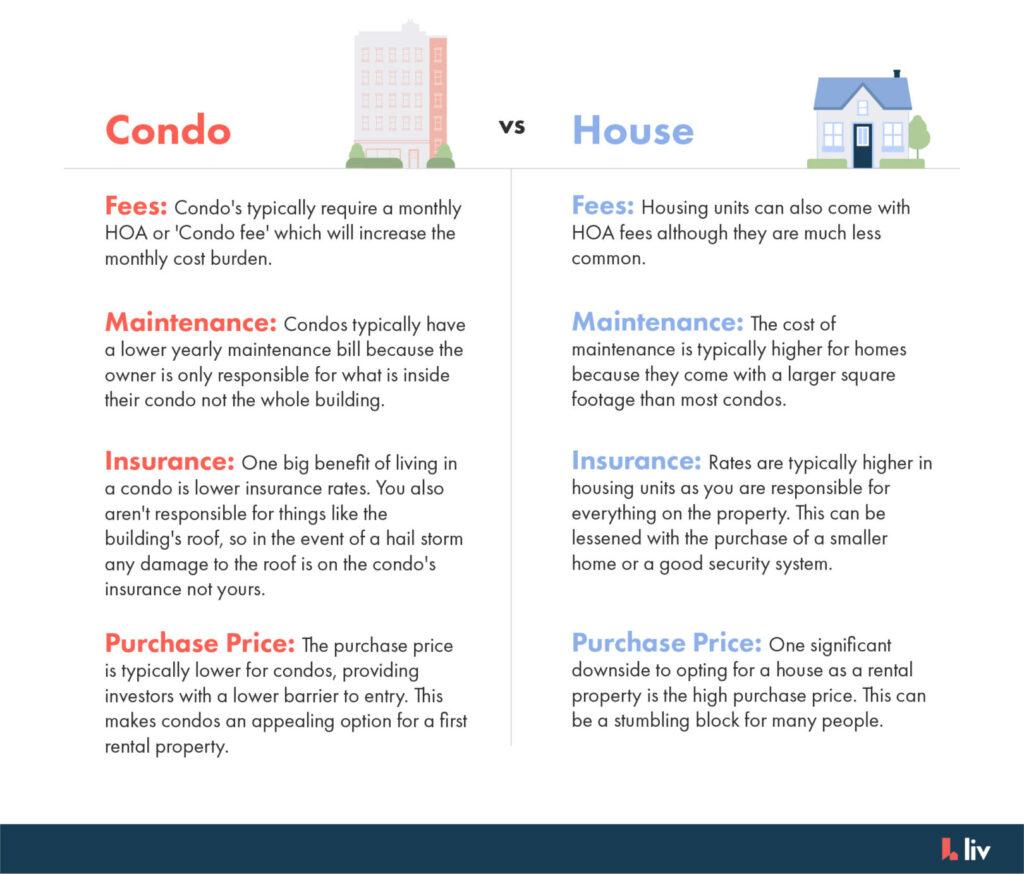

2. What type of property is best for you?

A big decision you have to make from the start is what type of property you want to buy, it’s important to consider how much time you have available to commit to issues that may arise from this property. Both houses and condos will come with some maintenance work, given the smaller footprint condos typically come with less. Depending on the building, you may also have access to an onsite property manager or concierge who can assist with the maintenance requests at your property for a fee. We dive into this topic a little later in this guide.

3. When should you consider financing?

Canadian banks are well-known for being conservative when looking to invest in rental properties, this means lots of hoops for you to jump through which may delay your timeline considerably. You should factor this in early, as it’s unlikely that you will be granted a mortgage as easily as your first property. You can take steps to help speed up this process, such as getting pre-approval, which typically lasts anywhere from sixty to ninety days depending on the lender.

The magic number that many banks look for is a debt-to-income ratio surpassing the 36% mark. What does this mean though? Debt to income refers to how much of your monthly income goes to paying your mortgage, typically the lower the ratio the better. This lets the bank know that you are in a good financial position and able to shoulder the burden of an additional mortgage.

How much money do you need to buy a rental property in Canada?

A figure that you will see mentioned a lot is needing to have 20% of your deposit ready, but why is this so important? If you have less than 20% of the total price of the property you are required to also purchase renters insurance which can add additional premiums to your monthly payments. The 20% rule doesn’t apply in every case it’s just a good rule of thumb for most people when looking for a mortgage. It’s best to research your province’s rules as there may be a better option and even some support made available to you.

Other factors you may want to consider:

- Closing Costs — One thing that often gets overlooked is factoring in closing costs. There are lots of different costs to cover but the major ones include land transfer tax, legal fees, inspection fees and title insurance. This calculator can help you estimate costs.

- Timing — You should always look to the market and try to identify if now is a good time to purchase a property. For example, after several years of high inflation Canadian homes are priced extremely high but we have recently seen a trend downwards in price.

- Taxes — While you do get some great tax benefits it’s important to consider how the purchase of a rental property will affect your taxes as a whole. You must pay Capital Gains tax upon the sale of the property and income tax on any rental income generated. These both will eat into your returns, but it is possible to offset this by making upgrades to the home so you can reap the full tax benefits. As well as this, if your mortgage costs are higher than the income generated from rent, you can deduct your rental loss against your other sources of income.

- Cost of rent — You should consider the average rent price you will charge for the property you are looking to purchase. You do this to know what you can expect to earn every month, and if it’s enough to cover your costs. This will give you a good idea if you’ll be at a net loss or gain every month.

Neo World Elite Mastercard

Looking for premium rewards on everyday essentials? The Neo World Elite® Mastercard offers up to 5% cashback on gas and groceries, plus exclusive travel benefits like Extended Warranty and Auto Rental Collision Loss coverage. With the potential to earn over $1,200 in cashback annually, it’s designed to elevate your spending power. Click here to find out more!

Do’s and Don’ts of purchasing a rental property

There is a lot to consider when purchasing an investment property and it can be easy to get bogged down. This section will lay out some important high-level things to make sure you get right, to make sure you are on the right path.

Dos

- Set a budget — It is important to be realistic when purchasing an investment property and plan accordingly. Will the property need renovations, is it ready to move in right away, how long has it been on the market? These are all important things to consider when setting a budget. There are some incentives that can help ease financial burdens.

- Determine how hands-on you want to be — This will largely affect the property type you choose, a townhouse or detached home will require more time investment whereas a condo will require a relatively low time investment.

- Get inspections — This could save you a lot of money down the line, by getting a home inspection you will catch any issues with the property. The average cost of a home inspection is roughly $500 depending on the size of the property.

- Check supports — Depending on a variety of other factors you may have some supports made available to you by the government. It’s important to check with your local and regional governments as they may have existing programs to assist you financially through low-interest loans, tax benefits and much more.

- Create a contract— Once you have the home ready to move in and a tenant lined up all that’s left is a contract. Liv.rent allows you to remove the stress of drafting your own lease agreement and revising endlessly. With liv.rent’s digital contract feature, create, send and sign your leases all in one go.

Don’ts

- Underestimate the time commitment — While rental properties are a great way to ensure you have a stable income over the long term as well as gaining tax benefits, they will not make you rich overnight. It is important to stay patient and slowly grow your investment.

- Go with unreliable tenants — The wrong renters can cause serious headaches for homeowners, including damaging the property, not paying rent, and disturbing you and your neighbours. Thankfully, it’s easier than ever to find reliable tenants through advanced tenant screening solutions like the Trust Score.

- Buy without doing your research — This may seem like common sense but can be a big mistake for many newer landlords. Make sure you research thoroughly everything about the property first before purchasing as this could save you money later. For example, if the property is in a flood zone this may drive insurance premiums up.

- Buy an older home— This largely applies to newer landlords, an older home will likely need repairs which can increase the cost burden and often put substantial financial pressure on newer landlords who do not have the resources to shoulder this burden.

Buying a house vs condo

>> Recommended Reading: The Trust Score: Explained For Landlords And Renters

Listing your investment property on liv.rent

There are plenty of advantages to listing your property on liv.rent. Designed specifically for modern landlords in Canada, this all-in-one platform has you covered for every step of the rental process. You can post on liv.rent and easily share to multiple different listing sites. This is especially helpful for first-time landlords & those who want to handle the process themselves, without a property manager. For first-time landlords in particular, we have everything you need, things like a centralized inbox for tenant communications and income statements can help you stay organized while maximizing your profits.

Landlords on liv.rent also benefit from our multi-layered verification processes for renters. As part of our commitment to building a safe & trusted rental community, we request renters upload documents to verify both their identity and income, as well as optional social media verification for an extra layer of security. When renters apply to your listing, you’ll be able to see their verification status with a handy checkmark to let you know that it’s safe to proceed.

Ready to get started? Here’s a quick video on how to post your property for rent on liv.rent:

FAQ: How to buy a rental property in Canada

Where can I find more resources on purchasing a rental property?

Can non-residents own a rental property in Canada?

What is the 1% rent rule in Canada?

Is it worth buying a rental property?

Can I rent out a property without telling my mortgage lender in Canada?

Rethink The Way You Rent

Not on liv.rent yet? Experience the ease of digital applications & contracts, verified tenants & landlords, virtual tours and more – all on one platform. Sign up for free or download the app.

Subscribe to receive the latest tenant & landlord tips and get notified about changes in the Canadian rental market.

>> Stay up-to-date on the average rent in Vancouver, Toronto and Montreal: Rent Reports.

0 Comments