[LAST UPDATED: December 28th, 2020]

The provincial and federal governments of Canada have unveiled sweeping assistance packages to help all Canadians through this unprecedented time. We at liv.rent are here to help landlords and tenants navigate the resources newly available to them during the COVID-19 pandemic.

For a quick summary of events impacting Landlords and Tenants, refer to our post: COVID-19 – Update For Landlords and Tenants.

For website directories and contact information, jump to the following sections:

Table of Contents

COVID-19 Helplines and Rental Support – By Province and Territory

Federal Financial Support in Response to COVID-19

Provincial Financial Support in Response to COVID-19

Financial Bank Support – Mortgage Deferrals & Emergency Relief Measures

COVID-19 Rental Support – By Province and Territory

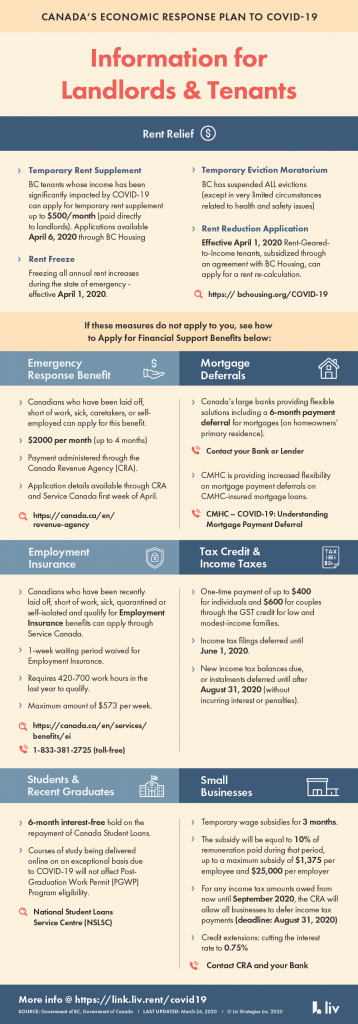

In addition to extensive federal initiatives outlined in Canada’s Economic Response Plan, each Canadian province and territory has made efforts to put forward measures surrounding rent relief, rent freeze, eviction bans and more to protect Canadian renters.

Below we’ve provided links to key resources to help landlords and tenants better understand the provincial and federal initiatives in place during the coronavirus (COVID-19) pandemic in Canada. The situation is fluid and constantly evolving, we encouraged you to visit resource sites regularly for up-to-the-minute information.

British Columbia

![]() Call 811

Call 811 ![]() Visit the BCCDC

Visit the BCCDC

BC UPDATE: December 28, 2020

BC Recovery Benefit: One time direct deposit payout of up to $1000. Open for applications as of December 23, 2020.

BC UPDATE: July 17, 2020

Temporary Rent Supplement – BC TRS: Extended until the end of August, 2020.

Rent Payments: No rent increase is permitted to take effect until December 2020. Notice to increase rent may be presented, however if the tenant pays the increase amount before December 2020, the tenant is eligible for refund of the increase amount. Tenants are required to resume rent payments in full on September 1st, 2020.

Rent Repayment: Landlords and tenants are required to enter into a rent repayment plan for any outstanding rent from March 18th – September 1st. These payments must be agreed upon by all parties, paid monthly, and completed by July 2021.

Eviction Prohibition: Landlords may not issue Notice to End Tenancy for Non-Payment of Rent if the tenant resumes rent payments in full on September 1st, unless the tenant had outstanding rent payments prior to March 18th, 2020. Late payments during the emergency period are not considered “cause” for eviction, and landlords cannot charge fees for any missed rent during the state of emergency. A tenant cannot be issued a Notice to End Tenancy for unpaid rent during the emergency unless they have defaulted on their repayment plan.

The provincial government has provided a variety of rent relief initiatives for eligible renters whose employment has been adversely impacted by the COVID-19 pandemic and has called for a moratorium on most evictions. For a list of provincial initiatives see BC’s COVID-19 Action Plan.

FREE Rent Repayment Template: Download Here

Alberta

![]() Call 811

Call 811 ![]() Visit Alberta.ca

Visit Alberta.ca

You may qualify for rent relief through emergency isolation support if you have experienced total or significant loss of income and are not receiving compensation from any other source directly due to COVID-19 and self-isolation requirements. Restrictions apply, see The Government of Alberta website for more details.

Saskatchewan

![]() Call 811

Call 811 ![]() Visit Saskatchewan.ca

Visit Saskatchewan.ca

The provincial government hasn’t announced specific relief for renters but has ensured job-protected leave and removed the requirement of 13 consecutive weeks of employment to accessing sick leave. For updates, visit The Government of Saskatchewan website.

Manitoba

![]() Call 1-888-315-9257

Call 1-888-315-9257 ![]() Visit gov.mb.ca

Visit gov.mb.ca

No specific provincial rent relief announced as of March 26, but Premier signalling some assistance is on the way. Call Manitoba Government Inquiry for updates: 1-866-626-4862 or 204-945-3744 or check Government of Manitoba website for updates.

Ontario

![]() Call 1-866-797-0000

Call 1-866-797-0000 ![]() Visit Ontario.ca

Visit Ontario.ca

Currently, the only provincial rent relief comes in the form of a moratorium on evictions. Renter advocacy groups are pushing the provincial government to do more. Visit Ontario.ca for updates.

Quebec

![]() Call 1-877-644-4545

Call 1-877-644-4545 ![]() Visit Quebec.ca

Visit Quebec.ca

Quebec housing officials are suspending some measures that would allow landlords to evict tenants or reclaim housing during the COVID-19 crisis. For updates, visit Government of Quebec website.

New Brunswick

![]() Call 811

Call 811 ![]() Visit NewBrunswick.ca

Visit NewBrunswick.ca

One-time income benefit of $900 to workers or self-employed residents who have lost their job due to the state of emergency. These funds will be administered by the Red Cross are intended to bridge the time between job loss or business closure and the time they receive their federal benefit. Visit Government of New Brunswick website for updates.

Newfoundland and Labador

![]() Call 811

Call 811 ![]() Visit gov.nl.ca

Visit gov.nl.ca

The province is currently working on rental relief as Premier Dwight Ball made a statement stating that help is coming from the provincial and federal governments for renters in Newfoundland and Labrador.

Nova Scotia

![]() Call 811

Call 811 ![]() Visit Novascotia.ca

Visit Novascotia.ca

The province has banned eviction on any tenants whose income has been impacted by COVID-19 and is promising support in the coming days. Visit the Government of Nova Scotia website for updates and other assistance information.

Prince Edward Island

![]() Call 811

Call 811 ![]() Visit PEI.ca

Visit PEI.ca

At this point, no provincial initiatives have been announced to help renters. Case count is still low in this province. Check here for updates.

Nunavut

![]() Call your local health center

Call your local health center ![]() Visit Nunavut

Visit Nunavut

As of March 25th there are no known or presumptive cases of COVID-19 in the territory and no renter-specific initiatives have been announced.

Northwest Territories

![]() Call 1-800-661-0844

Call 1-800-661-0844 ![]() Visit hss.gov.nt.ca

Visit hss.gov.nt.ca

No specific provincial assistance announced as of March 26th. Check here for updates.

Yukon

No specific provincial assistance for renters announced as of March 26th. Check here for updates.

Landlords & Property Managers

Advertise your rental for free on liv.rent – an all-in-one rental platform.

Federal Financial Support in Response to COVID-19

For Renters and Individual Landlords:

- Canada Emergency Response Benefit (CERB)- CLOSED

- Canada Recovery Benefit (CRB)

- Canada Recovery Caregiving Benefit (CRCB)

- Canada Recovery Sickness Benefit (CRSB)

- Individual and Family Support

- Senior Support

- Student and Recent Graduate Support

For Property Managers and Small Business:

- Work Sharing Program

- Temporary Wage Subsidy

- Business Credit Availability Program (BCAP)

- Tax-filing and Payment Deadline Extention

- Quickbooks Tips for Small Business Survival During COVID-19

>> Recommended Reading: COVID Relief For Landlords Canada

Financial Support for Renters and Individual Landlords:

1. Canada Emergency Response Benefit (CERB) CLOSED

While this benefit has closed, retroactive applications for the period of August 30-September 26 are still being accepted.

What is the Canada Emergency Response Benefit?

This taxable benefit would provide $2,000 a month for up to four months for workers who lose their jobs or significant income as a result of the COVID-19 pandemic.

Who is eligible?

- Workers have had to stop working due to COVID19 and do not have access to paid leave or other income support.

- Workers who are sick, quarantined, or taking care of someone who is sick with COVID-19.

- Working parents who must stay home without pay to care for children that are sick or need additional care because of school and daycare closures .

- Workers who still have their employment but are not being paid because there is currently not sufficient work and their employer has asked them not to come to work .

- Wage earners and self-employed individuals, including contract workers, who would not otherwise be eligible for Employment Insurance.

- On April 21, 2020 the federal government has extended eligibility to students.Students will be eligible for $1,250 a month from May through August and can increase to $1,750 if the student is taking care of someone or has a disability. The benefit is also available to students who have jobs but are making less than $1,000 a month.

How can I apply?

The Canada Emergency Response Benefit will be accessible through a secure web portal starting in April 6th. Applicants will also be able to apply via an automated telephone line or via a toll-free number. Call 613-369-3710 for general inquiries. Learn more on the Government of Canada website.

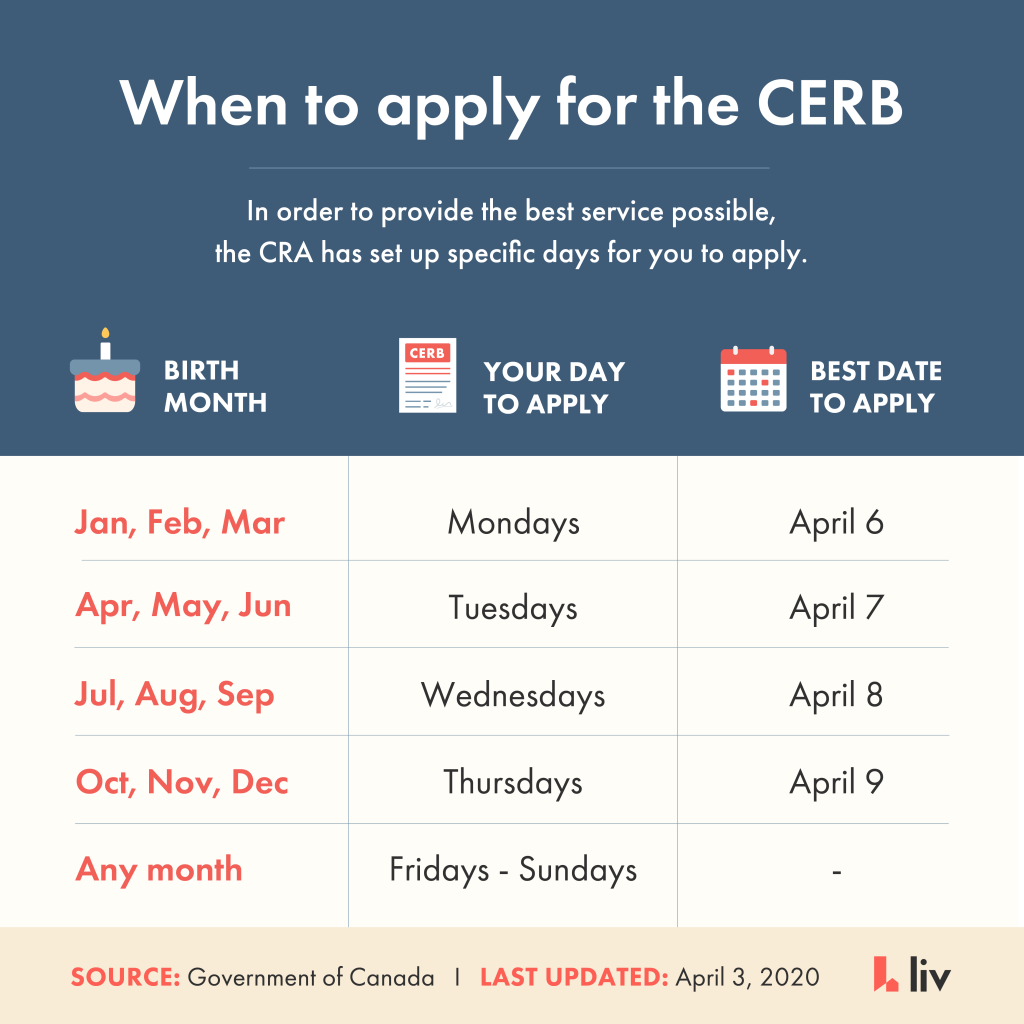

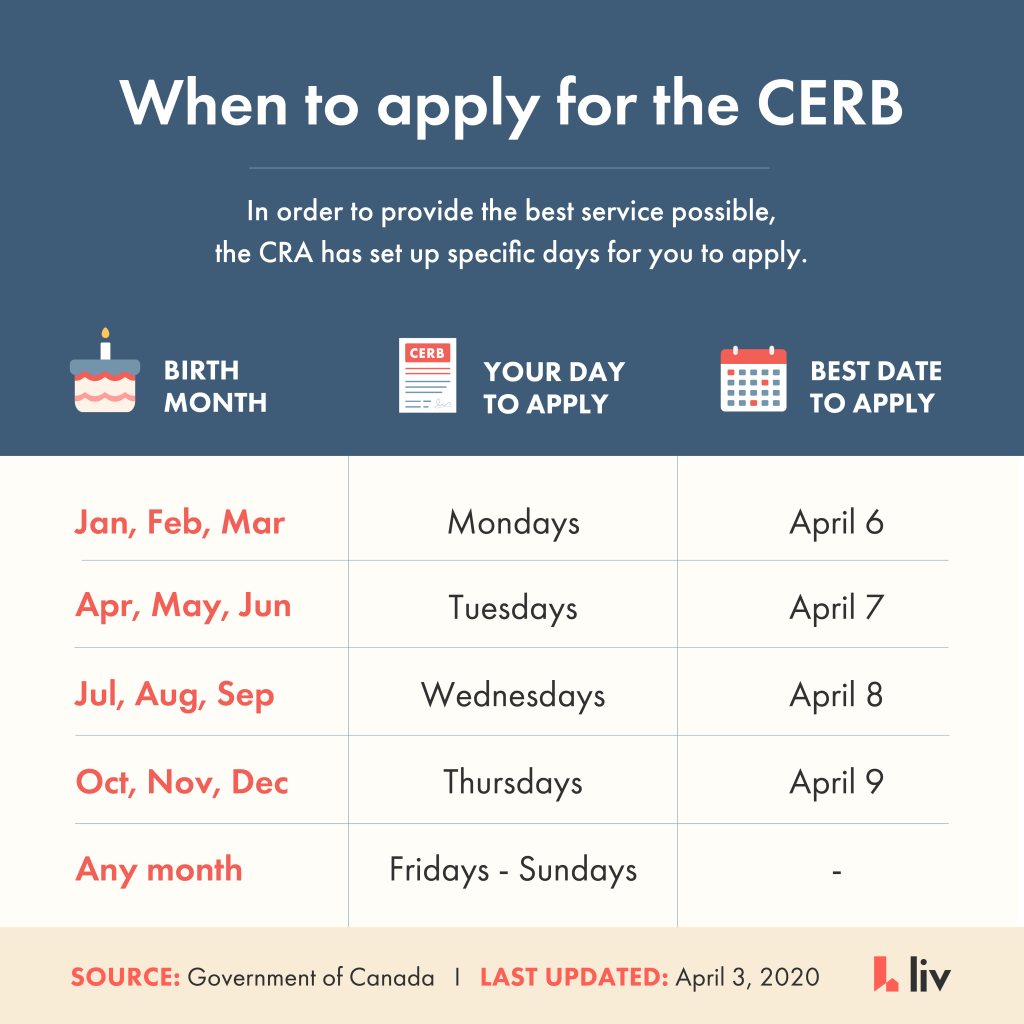

When do I apply?

To provide the best service possible, the CRA has set up specific days for Canadians to apply.

See more details here.

2. Canada Recovery Benefit (CRB)

The Canada Recovery Benefit (CRB) provides a payment of $1,000 (before taxes) for each 2-week period you apply for. The CRB is available for a maximum of 13 periods between September 27, 2020 and September 25, 2021.

Who is eligible?

Workers who are eligible for the CRB must meet the following criteria for the 2-week period that they apply for:

- They have had to stop working due to COVID-19 or have had a 50% reduction in average weekly income compared to the previous year due to COVID-19

- They did not apply for or receive CRSB, CRCB, short-term disability benefits, worker’s compensation benefits, Employment Insurance (EI) benefits, or Quebec Parental Insurance Plan (QPIP) benefits

- They were ineligible for EI Benefits

- Must reside and be present in Canada

- Must be at least 15 years old and have a valid Social Insurance Number (SIN)

- Workers must have earned at least $5,000 in 2019, 2020, or in the 12 months before the date of application from self-employment income, employment income, or maternity and parental benefits from EI or similar QPIP benefits

- Must not have quit their jobs or reduced hours voluntarily on or after September 27, 2020

- Must have been seeking income during the period in question, either as an employee or in self-employment, and have not turned down reasonable work in that time

How do eligibility periods work?

The Canada Recovery Benefit eligibility periods are exactly two weeks that begin and end on specific dates. They run consecutively from September 27, 2020 to September 25, 2020.

How can I apply?

The Canada Recovery Benefit will be accessible through the CRA secure web portal starting in October 12th. Applicants will also be able to apply via an automated telephone line or via a toll-free number, 1-800-959-2019 or 1-800-959-2041. The hours for this number are Monday to Sunday 6 am to 3 am EST.

The CRB does not renew automatically, thus applications must be submitted for each period that the above qualifications are met. The earliest one can apply is the first Monday after the 2-week period has ended. Retroactive applications will be accepted for up to 60 days after that period has ended. Learn more on the Government of Canada website.

3. Canada Recovery Caregiving Benefit (CRCB)

For individuals who are unable to work because they must care for their child under 12 years old or family members who need supervised care, the Canada Recovery Caregiving Benefit (CRCB) provides financial support for one-week periods. Eligible applicants may receive $500 (before tax) for each one-week period from September 27, 2020 to September 25, 2021.

Who is eligible?

Workers who are eligible for the CRCB must meet the following criteria for the 1-week period that they apply for:

- Applicant is unable to work at least 50% of scheduled work week due to caring for a family member

- Applicant is caring for a child (under 12 years old) or family member who needs supervised care because:

- The school, daycare, day program, care facility, or care service is closed or unavailable due to COVID-19

- They are sick with or have symptoms of COVID-19

- They are at risk of serious health complications if they get COVID-19, as advised by a medical professional

- They are self isolating due to COVID-19

- They did not apply for or receive CRSB, CRCB, short-term disability benefits, worker’s compensation benefits, Employment Insurance (EI) benefits, or Quebec Parental Insurance Plan (QPIP) benefits during the same period

- They were ineligible for EI Benefits

- Must reside and be present in Canada

- Must be at least 15 years old and have a valid Social Insurance Number (SIN)

- Applicants must have earned at least $5,000 in 2019, 2020, or in the 12 months before the date of application from self-employment income, employment income, or maternity and parental benefits from EI or similar QPIP benefits

- Must be the only person in the respective household applying for the benefit for the week

- Must not be receiving paid leave from employer for the same period

How do eligibility periods work?

The Canada Recovery Caregiving Benefit eligibility periods are exactly one week that begin and end on specific dates. Each household may receive payments for a maximum of 26 weeks between September 27, 2020 to September 25, 2020. These do not need to be taken consecutively.

How can I apply?

The Canada Recovery Caregiving Benefit will be accessible through the CRA secure web portal starting in October 12th. Applicants will also be able to apply via an automated telephone line or via a toll-free number: 1-800-959-2019 or 1-800-959-2041. The hours for this number are Monday to Sunday 6 am to 3 am EST.

The CRB does not renew automatically, thus applications must be submitted for each period that the above qualifications are met. The earliest one can apply is the first Monday after the 1-week period has ended. Retroactive applications will be accepted for up to 60 days after that period has ended. Learn more on the Government of Canada website.

4. Canada Recovery Sickness Benefit (CRSB)

For individuals who are unable to work because they are at greater risk of getting sick, are sick or need to self-isolate due to COVID-19, the Canada Recovery Caregiving Benefit (CRCB) provides financial support for one-week periods. Eligible applicants may receive $500 (before tax) for each one-week period from September 27, 2020 to September 25, 2021.

Who is eligible?

Workers who are eligible for the CRCB must meet the following criteria for the 1-week period that they apply for:

- Applicant is unable to work at least 50% of scheduled work week due to

- Being sick with COVID-19

- Being advised to self-isolate due to COVID-19

- Having an underlying health condition that puts you at greater risk of getting COVID-19

- They did not apply for or receive CRSB, CRCB, short-term disability benefits, worker’s compensation benefits, Employment Insurance (EI) benefits, or Quebec Parental Insurance Plan (QPIP) benefits during the same period

- Must reside and be present in Canada

- Must be at least 15 years old and have a valid Social Insurance Number (SIN)

- Applicants must have earned at least $5,000 in 2019, 2020, or in the 12 months before the date of application from self-employment income, employment income, or maternity and parental benefits from EI or similar QPIP benefits

- Must not be receiving paid leave from employer for the same period

How do eligibility periods work?

The Canada Recovery Caregiving Benefit eligibility periods are exactly one week that begin and end on specific dates. Each household may receive payments for a maximum of 2 weeks between September 27, 2020 to September 25, 2020. These do not need to be taken consecutively.

How can I apply?

The Canada Recovery Caregiving Benefit will be accessible through the CRA secure web portal starting in October 12th. Applicants will also be able to apply via an automated telephone line or via a toll-free number: 1-800-959-2019 or 1-800-959-2041. The hours for this number are Monday to Sunday 6 am to 3 am EST.

The CRB does not renew automatically, thus applications must be submitted for each period that the above qualifications are met. The earliest one can apply is the first Monday after the 1-week period has ended. Retroactive applications will be accepted for up to 60 days after that period has ended. Learn more on the Government of Canada website.

5. Individual and Family Support

Employment Insurance (EI)

Call 1-800-206-7218 (toll-free) or apply online, through the federal government, here.

Canada Child Benefit (CCB)

Apply online here if you haven’t already.

Tax-filing and Payment Deadline Extension

Tax filing extended to June 1, 2020. Balance and payments to September 1, 2020. Learn more about tax deferrals and payments, here.

6. Senior Support

Registered Retirement Income Fund (RRIF) – Withdrawal Reduction

The required minimum withdrawals from Registered Retirement Income Funds (RRIFs) have been reduced by 25% for 2020. Learn more here.

7. Student and Recent Graduate Support

Suspension of Federal Student Load

Payments have now resumed. Effective March 30, 2020, repayment of Canada Student Loans was paused until Sept 30, 2020. No interest was accrued during this time. Learn more.

Canada Emergency Student Benefit (CESB)- CLOSED

The CESB provides financial support to post-secondary students, and recent post-secondary and high school graduates who are unable to find work due to COVID-19 from May to August 2020. It is intended for students who do not qualify for the Canada Emergency Response Benefit (CERB) or Employment Insurance (EI).

Canada Student Service Grant program

Canada Student Service Grant program includes the government’s plans to create thousands of more temporary job openings for young people who are looking for work and experience this summer.

The grant to post-secondary students and recent graduates would provide one-time payments of up to $5,000 for volunteering in pandemic-related programs, depending on the number of hours worked. For every 100 hours spent, a student will receive $1,000.

liv.rent – Canada’s trusted house & apartment rental website

Search apartments, condos, and homes for rent.

Financial Support for Property Managers and Small Business:

1. Work Sharing Program

Employers can temporarily reduce employees’ work schedules and provide them with a reduced income, while Service Canada will pay a certain percentage of the lost income. Apply online here.

2. Emergency Wage Subsidy

This temporary wage subsidy has been extended until November 21, 2020, allowing eligible employers to reduce the amount of payroll deductions they have to pay to the Canada Revenue Agency (CRA) and up to a 75% wage subsidy, retroactive to March 15, 2020. This will help businesses to keep and return workers to the payroll. Learn more about this subsidy here.

3. Business Credit Availability Program (BCAP)

Though the Business Credit Availability Program (BCAP), Export Development Canada (EDC) and the Business Development Bank of Canada (BDC) more than $10 billion in direct lending and other types of financial support at market rates will be provided to Canadian businesses. Please contact your financial institution directly, and it will contact EDC and BDC where appropriate. Learn more about this program, here.

4. Tax-filing and Payment Deadline Extention – CLOSED

Tax filing deadline for businesses was extended to Aug 31, 2020. Learn more about these changes here, here.

Provincial Financial Support In Response to COVID-19

Individual provinces are adopting separate financial relief initiatives to complement the massive federal COVID-19 Emergency Response Plan introduced March 18th which commits up to $27 billion in direct support to Canadian workers and businesses. The provinces listed below have introduced financial support measures.

>> Recommended Reading: COVID-19 Rent Relief Canada – Rental Assistance By Province

British Columbia

BC has introduced sweeping measures to help British Columbians, however these measures have closed. Full details available here.

UPDATE DECEMBER 28TH: The BC Recovery Benefit is now accepting applications for a one-time payout of up to $1000. Most residents are eligible. See here for details.

UPDATE OCTOBER 6TH: The Temporary Rent Supplement has ended as of August 31, 2020. Tenants are required to resume rent payments in full on September 1st, 2020.

Alberta

Alberta is offering student loan deferrals, utility payment deferrals and more. The Emergency Isolation Support Fund is now closed for new applications. Visit Alberta.ca for details.

Saskatchewan

The province has announced a few measures including utility payment deferrals, self-isolation support funding and 3-month relief, penalty-free, from PST remittance for businesses. Full details here.

Manitoba

As of April 14th, the provincial government has not announced any specific direct financial assistance for residents affected by COVID-19. Eviction hearings have been postponed and rent increases have been frozen. More information on these, and other measures, here.

Ontario

The government is offering one-time payments of $200 per child to parents of children affected by school and daycare closures and additional help will be extended to low-income seniors, and the Ontario Works income support program will be expanded as well. For full details, visit Ontario.ca.

Quebec

The provincial government’s Temporary Aid for Workers Program is now closed for new applications. See this tool for more information on other government assistance programs available. For additional details, visit Quebec.ca.

New Brunswick

The province’s Rent Supplement Assistance Program is now closed to new applications. No further rental assistance has been announced as of April 14th. Their community supports can be found here.

Newfoundland and Labrador

The provincial government announced it will compensate private-sector employers to ensure employees do not go without pay during the pandemic. For details, click here.

Northwest Territories

Funding to the income assistance program in the Northwest Territories is being increased, the territory announced March 20. No other supports announced as of April 14th.

Nova Scotia

The province will award and extra $50 per payment to Nova Scotians on income assistance. In addition, the Worker Emergency Bridge Fund offers a one-time payment of $1000 for those who have lost work and don’t qualify for EI or CERB. For additional support details, click here.

Nunavut

As of April 14th, the government has not announced any specific direct financial assistance for residents affected by COVID-19.

Prince Edward Island

The province announced as much as $250 to workers with reduced hours, a $100 gift card for Sobeys to anyone who earned less than $25/hour and lost their job due to COVID-19, and other supports for self-employed residents. The Income Support Fund, offering a lump sum of $750, is accepting applications until April 30. For details, visit pei.ca.

Yukon

As of April 14th, the government has not announced any specific direct financial assistance for residents affected by COVID-19.

Financial Bank Support – Mortgage Deferrals and Other Emergency Relief Measures

Each bank is offering personal and business clients immediate financial relief during the COVID-19 pandemic. Their options vary and include mortgage payment deferrals, auto-loan, and personal loan payment deferrals and other financial supports to help alleviate the financial stresses brought difficult periods. Contact your bank and advisor for specific details and eligibility.

- BMO: Call 1-877-788-1923 or visit BMO website

- CIBC: Call 1-877-454-9030 or visit CIBC website

- HSBC: Fill out an HSBC request form to discuss financial relief options or visit HSBC website

- Laurentian Bank of Canada: Call 1-800-252-1846 or Laurentian Bank website

- National Bank: Fill out request form for mortgage deferral and visit National Bank for more info

- Scotiabank: Call 1-800-472-6842 or visit Scotiabank website

- RBC: Book an appointment to request for financial relief or visit RBC website for more info

- TD: Call 1-888-720-0075 or visit TD website

Job Opportunities

As more businesses and services are temporarily shuttering their doors, some are still looking for workers. We’ve assembled a list of such employers and some tools to help you get your job search started.

- AppJobs helps connect you with service apps that are constantly seeking more help. Through this site, you can find postings for positions with Uber, Instacart, TaskRabbit, and more.

- Recruiting In Motion is currently looking for General Labour and other Temporary to Full-time workers for their roster.

- Amazon and Microsoft are constantly updating postings for developer positions in the Greater Vancouver Area.

Downloadable Resources

Rent Repayment Template: Download Here

Landlord & Tenant COVID-19 Resources Infographic: Download Here

Rethink The Way You Rent

Not on liv.rent yet? Experience the ease of digital applications & contracts, verified tenants & landlords, virtual tours and more – all on one platform. Sign up for free or download the app.

Subscribe to receive the latest tenant & landlord tips and get notified about changes in the Canadian rental market.

>> Stay up-to-date on the average rent in Vancouver, Toronto and Montreal: Rent Reports.

Is there any help for landlords whose tenants are not paying rents? We cannot evict them, but yet banks are expecting either mortgage or line of credit payments and utility providers are expecting to be paid.

I am a landlord with just one rental property, an apartment condo. I am also a senior. I am struggling to re-rent my unit after my latest tenant moved out last month. I am also uncomfortable showing it due to the COVID-19 pandemic. The condo board has recently stopped allowing real estate agents into the building and are discouraging me from showing my unit. With this big drop in income, am I eligible for any federal benefits?

Hello,

I have been searching continually, trying to seek out information on my situation. To date I read and hear much about financial assistance available for Tenants during these present times of financial uncertainty during the Covid 10 crisis.

What about Landlords?? We are the ones taking the loss.

Particularly in situations such as mine where tenants moved out with 2 days notice on March 23. Hence no income for April and no time to find new tenants.In addition to the tenants not even paying fully for March yet.

I only see mention on news and website of situations where tenants are actually living in a place and are not able to afford rent, that monies will be forwarded to landlords.

And in my situation?? I would really appreciate being able to get some information and speak with someone about what one can do in this situation.

Thank you kindly

I have lost income because renters have left because of their loss of job because of the corona virus.Is there any help for me?j

Hello

I own %50 share of a semi-commercial building in Montreal. The building has 3 residential apartments and 3 commercial space. the area of the building is 3132sf. The 3 residential managed to pay their rent for April. One of the shops( small depanneur) paid his rent and 1/4 of owed municipal tax due on March1st. Another one (a small coffee shop) paid me 1/2 of his rent and 1/2 of his municipal tax due March1st. The last one (hair salon) also paid a part of his rent and 1/4 of his municipal tax. My tenants maid these unexpected payments on their own will and zero pressure from me. Up to here I have been lucky. My question is , for the coming months if the tenants (commercials or residential) will not be able to pay even a minimum; will be there a financial relief for landlords like my partner and I ? I can not pressure the tenants since 2 of them are closed and one is not functioning to his full potential due to present situation. Soon I have the municipal tax and GST/QST to pay, which is postponed but it is there to be paid. Both my partner and I also have obligations( payments) to be met every month and we need our good credit. Our source of income is this rental income! Is there any suggestion that can give me a bit peace of mind. I have contacted government of Quebec but there was not much of direction but referring me to Federal. I explained my situation hoping my questions could be brought up in a more official level since I am not the only one in this situation and I could not find any thing referring to small landlords and how should they pay for their own life expenses. Thanks,

Leila

Each bank is offering personal and business clients immediate financial relief during the COVID-19 pandemic. Their options vary and include mortgage payment deferrals, auto-loan, and personal loan payment deferrals and other financial supports to help alleviate the financial stresses brought difficult periods

Thanks

Thank you foor aany other informative site. Where else may just I get that kind off information written in such a perfect manner?

I’ve a project that Iam simply now running on, and I’ve bbeen on the look out for such info.