The housing market in Calgary is changing fast, and both renters and landlords are starting to feel the shift. As we look ahead to 2026, new developments, population growth, and economic changes are shaping what homes will cost and how easy they’ll be to find. Whether you’re searching for a place to live or managing a rental property, understanding these trends can help you make smarter decisions. In this guide, we’ll walk you through the key changes to watch for in the Calgary housing market so you can stay prepared and confident in the year ahead.

Calgary rental market overview

Rental market vacancy rate

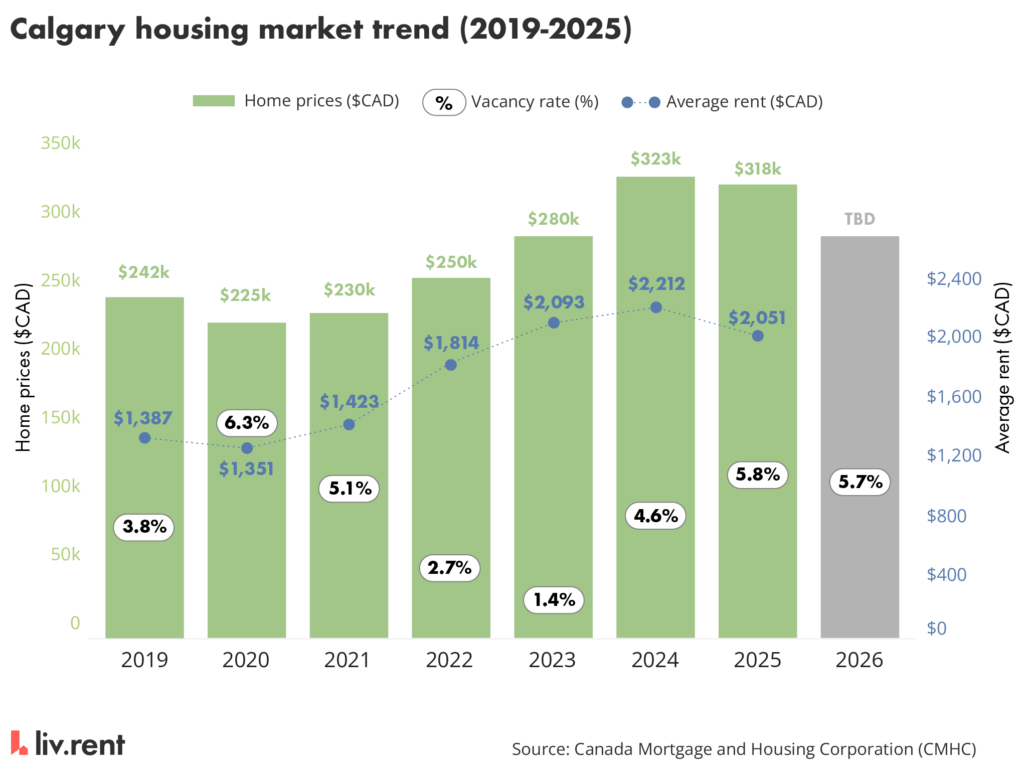

Calgary’s vacancy rate has been steadily shifting over the past few years, giving both renters and landlords a clearer picture of where the market is headed. According to Canada Mortgage and Housing Corporation (CMHC), after sitting at a tight 1.4% in 2023, availability opened up in 2024, rising to 4.6%, largely thanks to a wave of new purpose-built rental buildings.

This upward trend continued into 2025 with vacancy reaching 5.8%, offering renters more choice and easing competition. By 2026, the rate is expected to level slightly at 5.7%, suggesting a more balanced market where supply and demand are starting to align. These changes signal a gradual move toward stability, making it easier for renters to find homes and giving landlords a clearer path to setting competitive rates.

Join Our Newsletter

For more info on rental laws and policies (e.g. eviction, lease agreements, repairs & maintenance), subscribe to get the latest news.

Average rent in Calgary

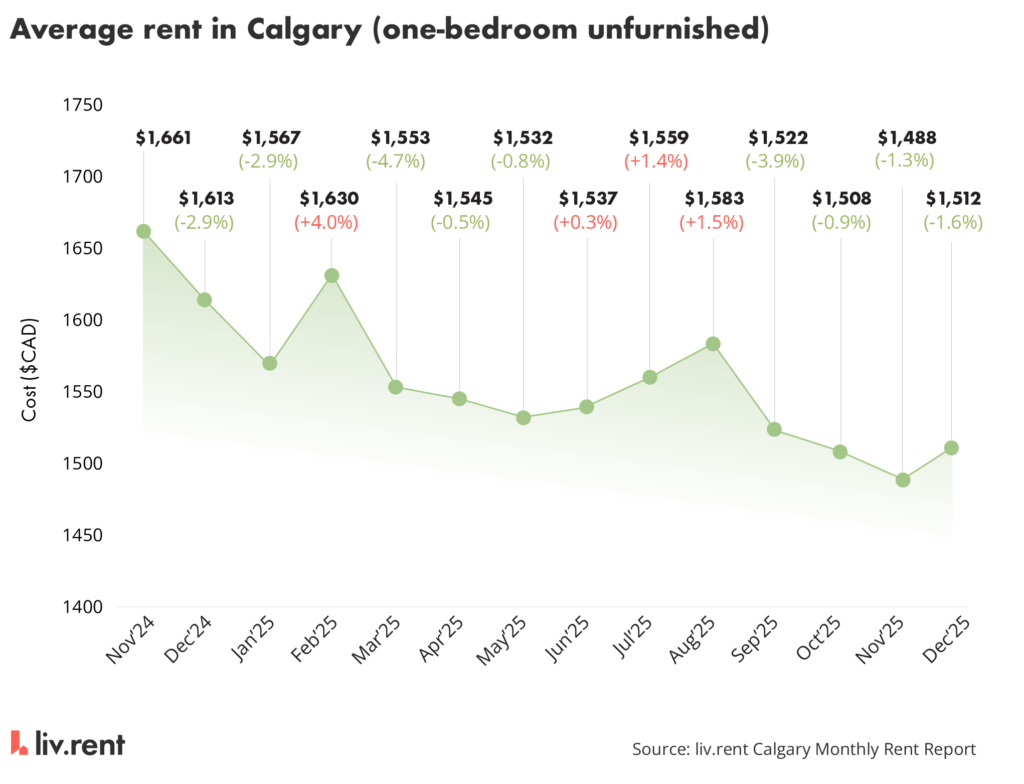

This graph shows how average rent for one-bedroom unfurnished units in Calgary shifted from late 2024 through the end of 2025—and the trend is noticeably downward overall. After peaking at $1,661/month in Nov 2024, rents steadily declined through early 2025 as vacancy rates increased and more rental units became available across the city. Although there were a few brief bumps—like the small rise in Feb 2025 and again in July–August 2025—these were short-lived.

By late 2025, rents had dipped to around the $1,500/month range, reflecting a market where renters had more options and landlords had to stay competitive with pricing. This pattern lines up with the broader shift seen in the city: growing supply from new purpose-built rentals and changing demand pressures are helping cool what had previously been a very tight rental market.

Calgary home prices overview

Home prices in Calgary 2023 vs 2025

| Housing Type | 2023 Price | 2025 Price | % Change |

| Apartment | $280,000 | $318,000 | 13.57% |

| Detached | $645,000 | $690,000 | 6.98% |

| Semi-Detached | $541,500 | $572,500 | 5.72% |

| Row Townhouse | $395,000 | $419,000 | 6.08% |

Home prices in Calgary 2023 vs 2025

This table shows how Calgary home prices have changed from 2023 to 2025, and while the market is cooling overall, prices are still rising—just at a slower, more moderate pace compared to previous years. These years were compared due to the rental market vacancy spike between 2023 and 2025, and how post pandemic levels contrasted over time. Apartments saw the biggest increase at 13.57%, likely due to continued demand for more affordable entry-level housing. Detached homes rose by 6.98%, while semi-detached and row townhouses increased by 5.72% and 6.08%, respectively. These steady but softer gains reflect a market that’s easing off the rapid growth of recent years, moving toward more balanced conditions for both buyers and sellers.

How will changes in Calgary’s home prices impact the rental market?

Calgary’s slowing but steady home-price growth may keep many buyers renting longer, especially as apartments saw the biggest jump in prices. With demand for affordable options still strong, rental pressure will likely stay high. Overall, the market is cooling, but rising prices mean rentals should remain competitive and in steady demand.

Calgary’s housing demand

Population growth and migration trends

Alberta’s population growth is beginning to cool, with Q2 2025 adding 19,268 people, down from 51,335 in the same quarter of 2024. Most of this slowdown comes from a sharp drop in international migration—the biggest decline since 2020. Even so, Alberta continues to lead the country in interprovincial migration, gaining 6,187 people in Q2 2025. Overall, the province is still growing, just at a more manageable pace than previous years.

New housing projects

Calgary saw 5,190 housing starts in Q3 2025 according to the City of Calgary, the highest of any Canadian city, driven mainly by strong growth in apartment construction. Apartment starts rose 6% to 2,960 units, including 1,651 purpose-built rentals, an impressive 18% increase from last year. Meanwhile, ground-oriented homes declined, with single-family builds down 14%, rowhouses down 4%, and semi-detached homes down 20%. With 17,342 starts so far in 2025, Calgary is on track to break its annual record for the third straight year. Apartments now make up 60% of all new housing, while single-family homes account for just 21%, marking a major shift in the city’s long-term building trends.

Housing under construction

According to the City of Calgary, there are currently 22,366 housing units under construction in Calgary, up 12% compared to last year. Apartments make up the majority, with 15,826 units—or 71% of all new construction. Rowhouses are also growing, with 2,226 units underway (a 14% increase), while semi-detached homes have dropped 9% to 1,104 units. Single-family home construction remains steady at 3,210 units, reflecting a clear focus on multi-family housing in the city’s development plans.

Forecasts for Calgary’s rental market

Vacancy and rent predictions

Calgary’s housing market is clearly shifting toward a more balanced and renter-friendly environment as we head into 2026. A surge in purpose-built rentals—now 41% of new housing with 2,742 units—is giving renters more options and easing pressure on rents. With vacancy rates expected to approach 6%, renters have more negotiating power, while landlords are adjusting to a market that is no longer as tight as it was just a few years ago.

At the same time, multi-family construction dominates the city’s growth, with apartments making up 71% of units under construction, signaling that Calgary is actively addressing the demand for urban rental housing. For both renters and landlords, the key takeaway is that the market is stabilizing: growth is still happening, but it’s becoming more predictable, creating opportunities for smarter decisions whether you’re looking to rent, invest, or manage property.

Calgary Housing Market FAQs

How is the rental market in Calgary – are rents going up?

Rents are stabilizing as more purpose-built rentals enter the market, easing pressure on prices.

What is the current rental vacancy rate in Calgary?

Calgary’s vacancy rate has risen toward about 5.7–6%, giving renters more choice.

How is population growth affecting rental demand in Calgary?

Slower population growth is easing demand slightly, though steady interprovincial migration still supports rental needs.

Are Calgary house prices dropping?

Home prices aren’t dropping but are rising at a slower, more moderate pace than previous years.

Is it worth moving to Calgary in 2026?

With more rental supply, moderating prices, and steady job and population growth, 2026 is shaping up to be a promising time to move to Calgary.

0 Comments