Edmonton housing market overview 2026

Edmonton’s housing market in 2026 is settling into an interesting rhythm. After a year of steady price growth in 2025, home values are still on the rise, but at a more comfortable, sustainable pace. With more listings hitting the market, buyer demand holding strong, and supply and demand finding better balance, the landscape is shifting in meaningful ways. Add in continued population growth and migration to the city, and there’s plenty influencing how Edmonton’s real estate market is shaping up this year. Let’s dive into the key housing and rental trends to watch in 2026. Also, be on the lookout for our annual rent report for deep insights into what happened in the rental market in 2025.

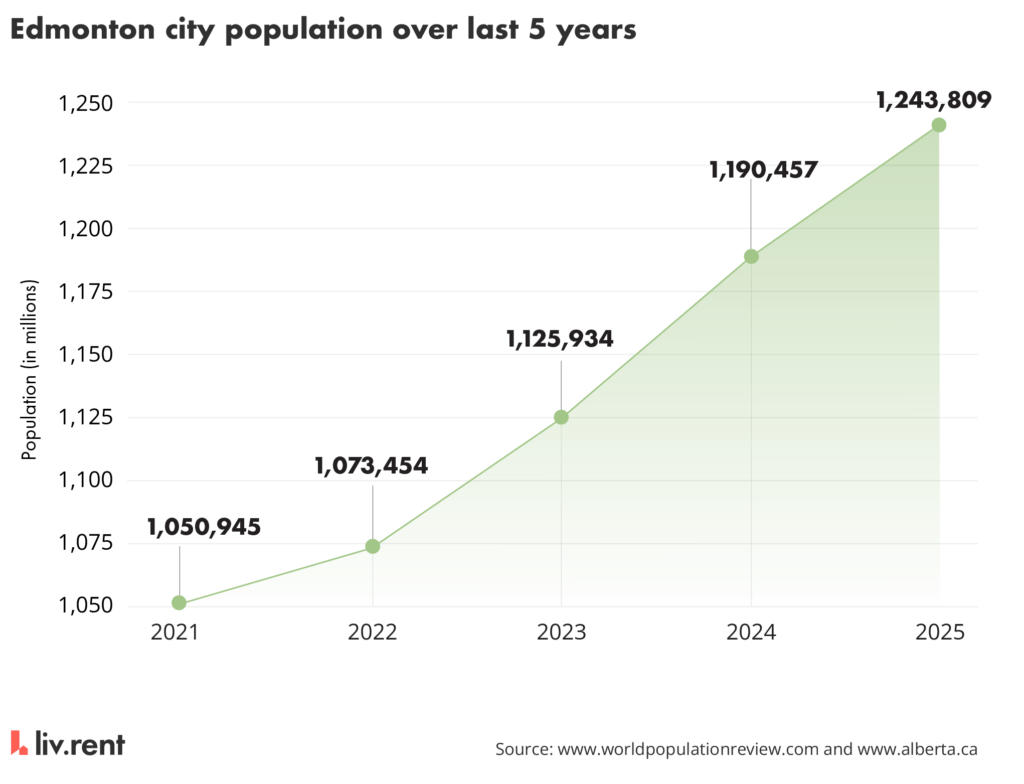

Edmonton population in last 5 years

Over the past five years, Edmonton has seen steady and meaningful population growth, adding more than 200,000 residents and emerging as one of Canada’s fastest-growing major cities. Strong interprovincial migration, international immigration, and relative housing affordability have attracted new residents. This sustained growth has increased demand for both ownership and rental housing, reinforcing market stability and supporting continued residential development across the city. Although immigration levels were more closely monitored and regulated in 2025 and will continue to be through 2026, the city still continues to attract due to affordability.

Join Our Newsletter

For more info on rental laws and policies (e.g. eviction, lease agreements, repairs & maintenance), subscribe to get the latest news.

Home price trends in Edmonton (2026)

According to estimates from REMAX Canada, Edmonton’s home prices are expected to keep rising in 2026, but at a slower and more manageable pace. After a noticeable increase in 2025, prices are forecast to grow by about 4% next year. This means homes should remain in demand without becoming drastically more expensive, as more listings and balanced market conditions help keep price growth steady rather than extreme. Let’s have a look at some more insights collected from REMAX Canada.

Average residential sale price 2024 vs 2025:

Edmonton’s average residential sale price increased from $431,994 in 2024 to $459,179 in 2025, reflecting a 6.3% year-over-year gain. This growth indicates continued buyer confidence and resilient demand despite a moderation in overall market activity.

Number of sales 2024 vs 2025:

Total residential sales declined from 25,297 transactions in 2024 to 23,878 in 2025, a 5.6% decrease. The slowdown suggests a more cautious buyer environment as affordability and supply conditions continue to rebalance the market.

Number of listings 2024 vs 2025:

Active listings rose from 33,135 in 2024 to 35,931 in 2025, marking an 8.4% increase year over year. Higher inventory levels expanded buyer choice and reduced competitive pressure across Edmonton’s residential market.

2026 avg. price estimate:

Edmonton’s average residential price is projected to rise by approximately 4.0% in 2026, bringing the estimated average price to $477,546. Forecasted growth reflects stable demand supported by balanced market fundamentals.

2026 avg. sales estimate:

Residential sales are expected to decline modestly by an estimated 2.0% in 2026. This outlook aligns with balanced market conditions, where steady inventory and measured demand support sustainable transaction volumes.

How will changes in Edmonton’s home prices impact the rental market?

Rising home prices in Edmonton are likely to keep more people renting in the near term. As buying becomes slightly more expensive, some would-be buyers may delay purchasing, which supports steady demand for rentals. At the same time, higher prices and slower sales signal a more balanced market, helping prevent sharp rent spikes while still keeping competition healthy for well-priced rental homes.

Edmonton rental market trends (2026)

Rental demand:

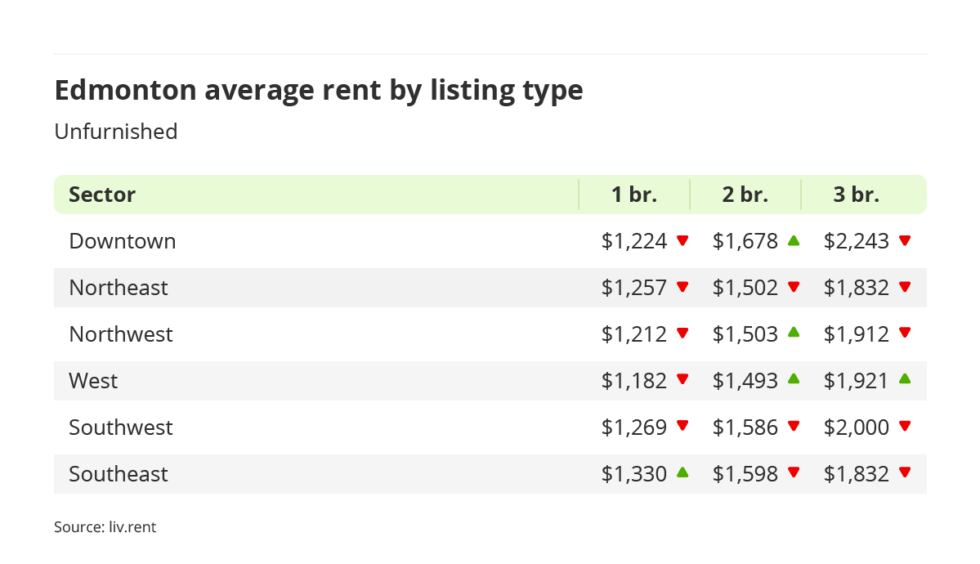

Edmonton’s rental market has cooled, especially for one-bedroom apartments, as seen in our December 2025 monthly rent report. Rents have generally gone down across most parts of the city, whether units are furnished or unfurnished. Downtown and the southwest saw some of the biggest drops, while only a few areas, like southeast Edmonton, saw small increases at the end of 2025.

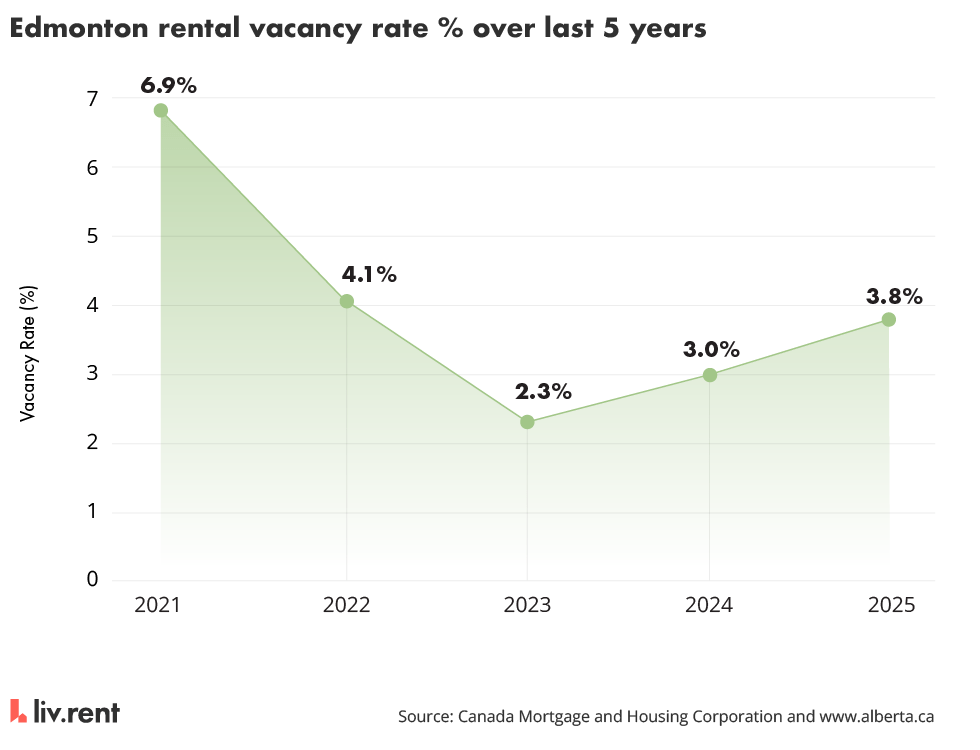

Vacancy rate:

Edmonton’s rental vacancy rate has tightened significantly over the past five years. After sitting high at nearly 7% in 2021, vacancies dropped sharply through 2022 and 2023, reaching a low of just over 2%. While vacancy rates rose slightly in 2024 and 2025, they remain below earlier highs. This means rental supply is still relatively tight, giving landlords stable tenant demand, even as renters now have slightly more choice than during the peak shortage years.

Supply pressure:

Edmonton’s declining vacancy rates show that rental supply has tightened compared to previous years, driven by strong population growth and steady tenant demand. While vacancy has edged up slightly since 2023, it remains low enough to keep pressure on available units, supporting stable rents and high occupancy for landlords.

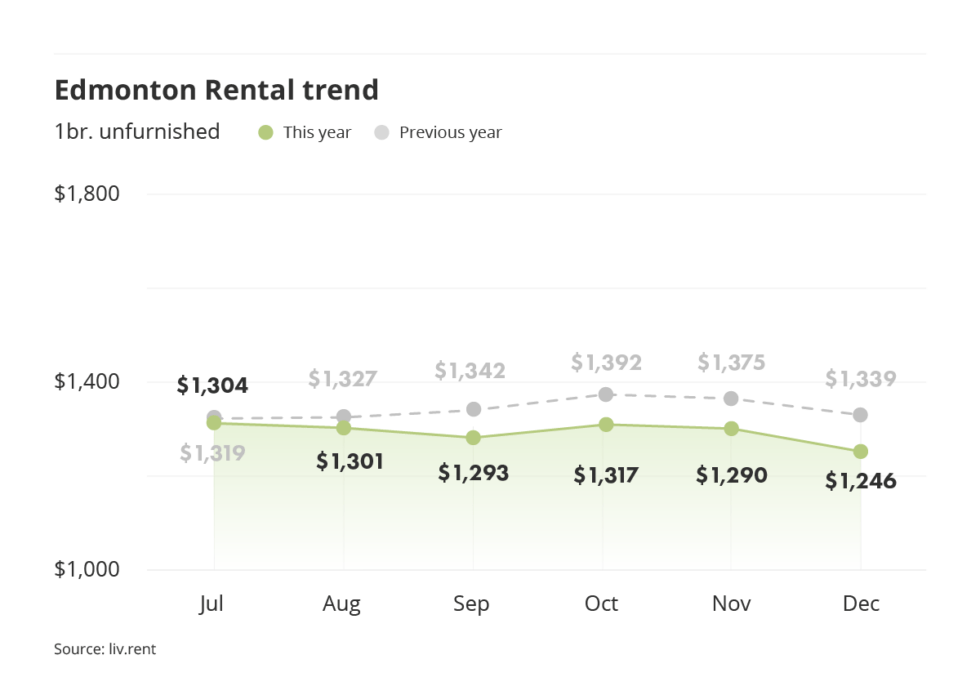

Average rent trends in Edmonton: rent growth by unit type

Unfurnished one-bedroom apartments now rent for about $1,246 per month on average, marking a decline from both last month and last year. Furnished one-bedrooms have also become more affordable, averaging $1,442 per month, though they still command a premium. Larger units show mixed trends, with some two-bedrooms rising in select areas, while most three-bedroom rents have fallen, improving renters’ negotiating power.

Neighbourhood-level rent variations

Rental trends vary by neighbourhood across Edmonton, showing a more localized market shift. Most areas saw rent decreases for unfurnished one-bedroom units, with Southeast Edmonton as the main exception. Unfurnished three-bedroom rents also eased in most sectors, while West Edmonton stood out for stability. Notably, furnished rentals declined in West Edmonton, giving renters more negotiating power depending on location.

What this means for landlords in Edmonton (2026)

In 2026, Edmonton landlords are operating in a more balanced and competitive rental market, according to insights from REMAX Canada. Softer demand, especially for one-bedroom units, means pricing, presentation, and location matter more than ever. With easing vacancy and more choice for renters, well-maintained and well-priced properties lease faster, while overpriced units may sit longer. Landlords who stay flexible, understand neighbourhood-level trends, and adjust rents or incentives strategically will be best positioned to protect occupancy and long-term returns.

Opportunities for landlords

A more balanced rental market creates opportunities for landlords who adapt quickly. With renters having more choice, offering competitive pricing, flexible lease terms, or small upgrades can help attract and retain tenants. Neighbourhoods with stable demand still present strong leasing potential, and landlords who focus on long-term tenants can benefit from steady cash flow and reduced turnover in 2026.

Best investment property types

Older walk-up apartments and well-located low-rise buildings remain some of the strongest investment options in Edmonton. These properties tend to have lower operating costs and appeal to budget-conscious renters. Larger units, especially two- and three-bedroom homes, also stand out as families gain more negotiating power but still value space and affordability.

What this means for renters in Edmonton (2026)

In 2026, Edmonton renters continue to benefit from a rare balance of affordability and opportunity. While citywide averages are still slightly up year-over-year, they remain among the lowest of any major Canadian city, offering residents stability, choice, and room to plan financially in a shifting national market.

Rent prices: still rising, but growth is slowing

Rent prices in Edmonton are still climbing, but the pace has eased compared to earlier years. Average apartment rents rose from about $1,529 in late 2024 to roughly $1,573 in early 2025, showing steady but more moderate growth. While demand remains strong, higher interest rates, tighter financing, and a shifting national market have helped cool rapid increases, making rent hikes feel more manageable than in many other Canadian cities.

Competition: well-priced units move quickly

Rental demand in Edmonton remains high, especially for well-priced and well-located units. Interprovincial migration continues to bring new renters into the city, keeping vacancy rates low. As a result, units that are clean, affordable, and fairly priced tend to lease quickly, sometimes within days. Renters who are prepared and flexible often have the best chance of securing desirable apartments before they’re snapped up.

Affordability still favours Edmonton renters

Even with rising rents, Edmonton remains the most affordable major rental market in Canada. Average rents are far below those in cities like Toronto and Vancouver, where monthly costs often reach $2,500 to $3,000. This affordability gives renters more breathing room in their budgets, allowing for better lifestyle balance, lower housing stress, and greater financial flexibility compared to most large urban centres.

Renters vs buyers: the cost comparison

In 2026, the cost comparison between renting and buying in Edmonton comes down to flexibility versus long-term investment. Renting remains the more affordable short-term option, especially as rent growth slows and choice improves across neighbourhoods. Buying, while more expensive upfront, continues to appeal to those planning to stay put and build equity in a steadily appreciating market. Ultimately, the better option depends on lifestyle, financial readiness, and how much certainty you want in a changing housing landscape.

FAQs: Edmonton housing market

Will rental prices go down in 2026 in Canada?

Rental prices in Canada are expected to grow more slowly in 2026, with some markets seeing flat or modest declines, but a broad nationwide drop is unlikely.

How much can rent increase in 2026?

Rent increases in 2026 depend on provincial rules, but in Alberta there is no cap, while other provinces limit increases to government-set guidelines, typically between 2% and 4%.

What is the forecast for Alberta real estate in 2026?

Alberta’s real estate market is forecast to see moderate price growth in 2026, supported by population growth, relative affordability, and more balanced supply conditions.

What is the rental vacancy rate in Edmonton?

Edmonton’s rental vacancy rate sits in the low-to-mid 3% range, indicating a tight but improving rental market compared to the extreme lows seen in 2022–2023.

Does Edmonton have rent control?

No, Edmonton (and Alberta) does not have rent control, but landlords can only raise rent once per year and must provide proper written notice.

0 Comments