Doing taxes can be hard enough, but add in the fact that you’re a non-resident and there was a global pandemic last year and you have a whole host of new problems.

To help clear up tax confusion, liv.rent was joined by TurboTax for a live liv.talk webinar that served as a renter’s how-to guide to getting a bigger tax return.

This webinar is perfect for non-residents or newcomers to Canada who are filing their Canadian tax returns for the 2024 tax year. Anyone who’s working or studying in Canada temporarily will want to hear all these tax tips.

At this informational webinar, you’ll get an overall look at how Canada’s taxation system works, how to file your taxes, and tips for maximizing your return. Of course, everyone has a unique tax position and it’s ultimately your responsibility to comply with the rules, we can only help show you what those are. Keep up with the Canada Revenue Agency (CRA) to learn about their latest news and updates.

Download The Renter’s Guide To Getting A Bigger Tax Return

The ultimate tax guide for renters in Canada. Everything you need to know about taxes, and how to get a bigger return.

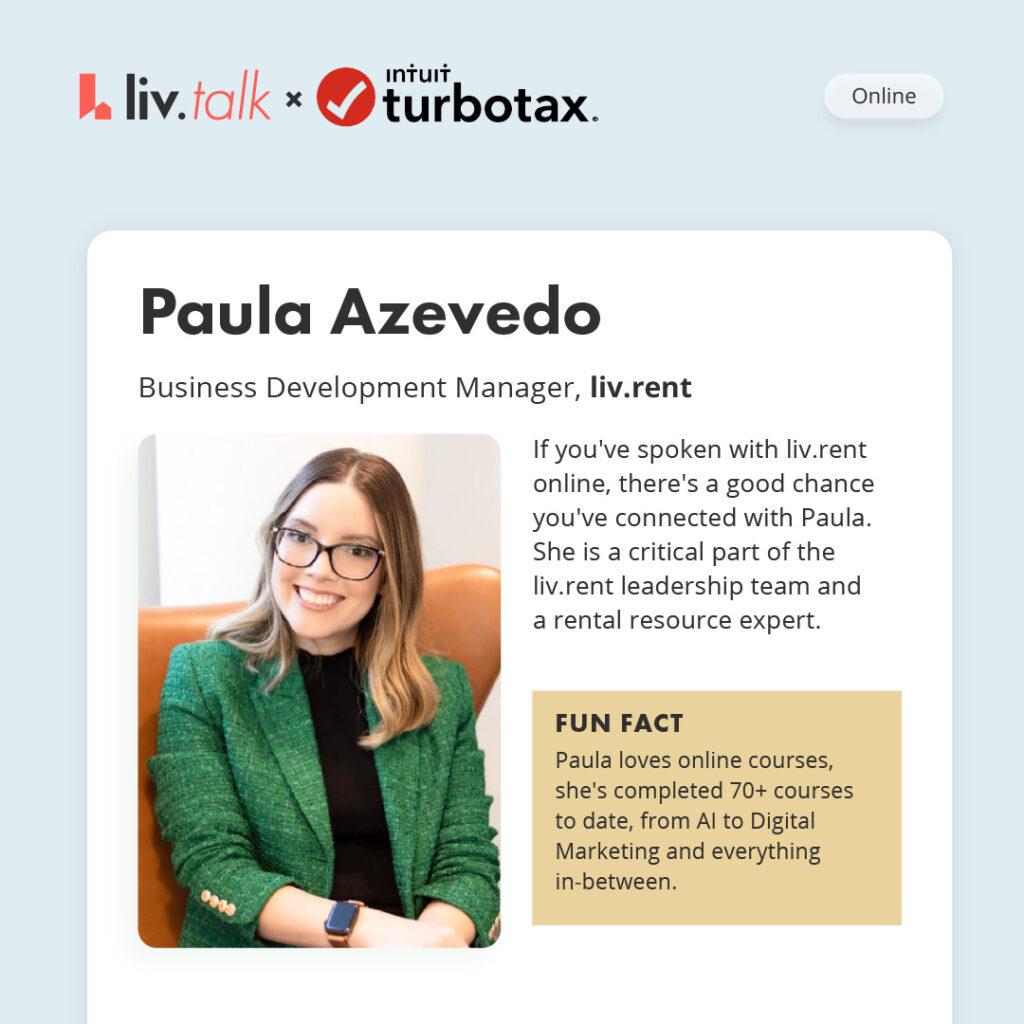

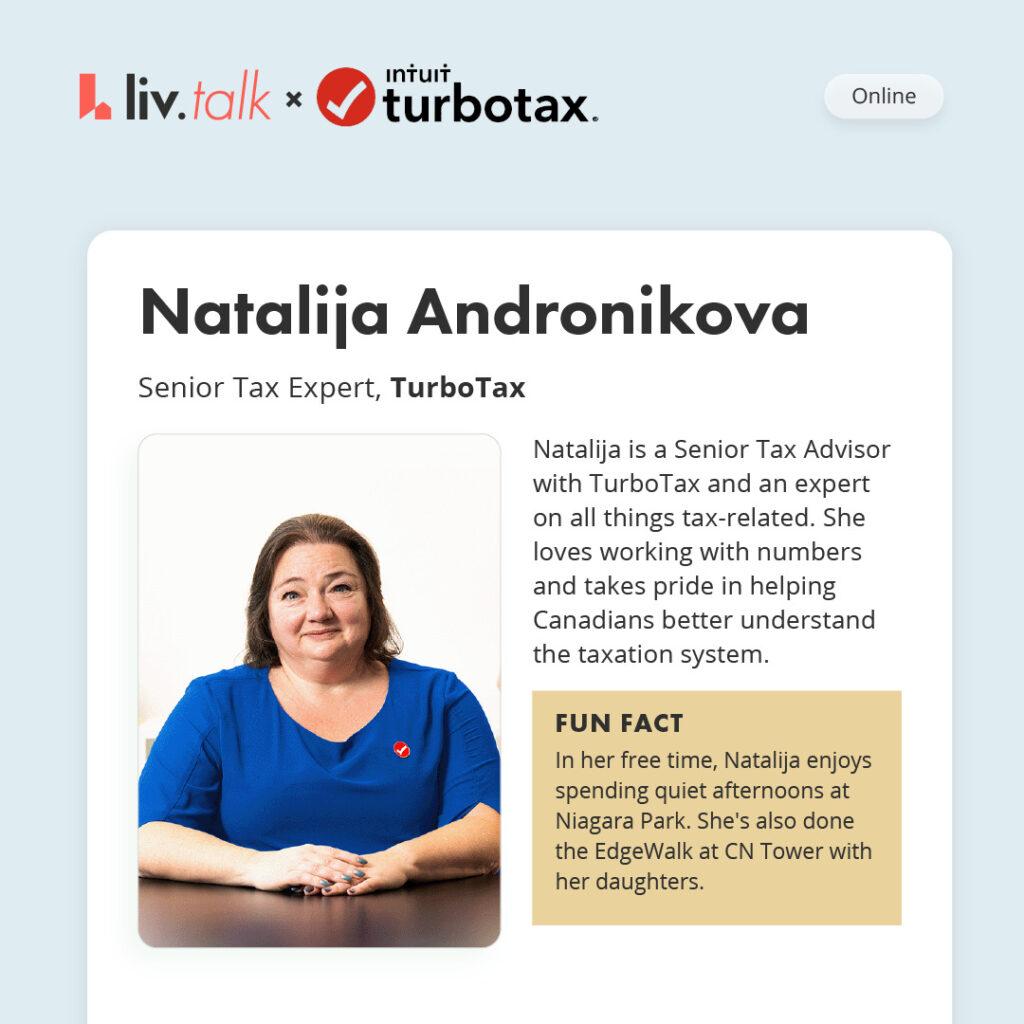

Meet our webinar leaders: liv.rent’s Business Development Manager, Paula Azevedo, was joined by Natalija Andronikova, a Senior Tax Expert at TurboTax.

Video transcription

This article is a partial transcription from our liv.talk live webinar Renter’s Guide To Tax Deductions ft. Turbo Tax. Watch the video and download the guide to get our complete insights.

1. Tax 101: basic tax principles for non-residents

When it comes to tax, you have to start with the basics. At our webinar we will be going over:

- An overview of the Canadian tax system

- Important tax dates for 2025

- What happens if you miss the tax deadline

- How to determine your tax residency

Canada’s tax system

In Canada, we have a progressive tax system. That means that the more money you are earning, the more taxes you’ll have to pay on it.

Not only is there federal tax to pay in Canada, but there will also be provincial tax, which is different depending on which province you are calling home.

In Canada, the federal tax-free allowance in 2024 is $16,129 for individuals earning a net income up to $253,414. Typically, you want to file your taxes every year, and there can be consequences for not doing so.

What generally happens is that most people, including non-residents, overpay tax each year. This results in a tax refund, and our webinar is going to show you how to make sure that the refund is as big as possible.

In our webinar, we will look at what it means when there’s an overpayment of:

- Income tax

- Canadian Pension Plan (CPP)

- Employment Insurance (EI)

What do you need to prepare your tax return?

Before you do your taxes, make sure that you have this information and all of these documents available:

- Social Insurance Number

- T4 document

- T4A

- T2202

- ID (Passport)

- Receipts

- Entry and exit dates

Important tax dates for 2023

Get out your calendar apps because there are some key dates you have to know for “Tax Season.”

The Canadian tax year follows the calendar year. It goes from the first of January to the 31st of December and taxes are always filed at the beginning of the following tax year.

The earliest you can file your returns would be on February 20 this year when the tax office officially opens its doors.

Here are some more key dates to note in Canadian tax season:

- February 29th — Deadline for receiving your T4 document from your employer

- April 30th —Tax filing deadline

- June 15th — Self-employed tax filing deadline

- April 30th — Date by which any amount owing to CRA must be paid

What happens if I don’t file my tax return?

It pays to file your taxes. You are legally obligated to file your tax return. If you don’t, it could affect your future immigration status.

Also, you could be subject to fines, penalties, and interest on the money that you owe to the CRA. Plus, they’ll charge you a 5% penalty and an extra 1% of your amount owing for each month you didn’t file.

How do you find out what your tax residency status is? And, what happens if you miss a tax deadline? Watch the video and download the guide to find out.

Changes to federal income tax brackets

Canada’s income tax brackets are created by the CRA to determine how much income tax you have to pay each year. These are decided based on buying power, which is directly related to the cost of goods & services – which is in turn affected by inflation.

Here’s a breakdown of the new tax brackets for the 2024 tax year:

- 15% on the portion of taxable income that is $57,375 or less, plus

- 20.5% on the portion of taxable income over $57,375 up to $114,750, plus

- 26% on the portion of taxable income over $114,750 up to $177,882, plus

- 29% on the portion of taxable income over $177,882 up to $253,414, plus

- 33% on the portion of taxable income over $253,414

2. Tax hacks to get a bigger return

In our webinar, we’ll be looking at five key areas where you can help yourself get a bigger return:

- T2202 Tuition & enrolment certificate

- Expenses

- Medical expenses

- TD1 Form

- Tax Forms T4 & T4A

1. T2202 Tuition & enrolment certificate

The T2202 form is the official income tax receipt issued by qualifying educational institutions. It’s for students to be able to claim tuition, education, and textbook tax credits. These forms are usually available for you to download from your school’s online portal.

To be eligible, you must have paid more than $100 in fees. Plus, you can claim both a federal and provincial tax credit for the tuition amount.

In order to calculate your tax credit, you simply multiply the tuition you paid by the federal tax rate (15% on the first 53,359). If you can’t use the entire credit this year, you can carry over the remaining amount to another year. To find this, navigate to “Go To Tax Returns” on CRA website, then go to “View Carryover amounts”

2. Expenses

If you earned more than the basic personal amount, then you can claim the cost of expenses to reduce your overall tax liability.

Examples of these eligible expenses include:

- Medical, including visits to the doctor, prescriptions, and surgery

- Tuition fees (T2202)

- Donations

- Union dues

- Work From Home expenses, including rent, supplies, travel, and professional fees

Of course, if you are going to claim some of these expenses to bring down your tax liability, then you have to be prepared. Keep documentation and receipts for each cost.

3. Medical expenses

You can also claim medical expenses that you paid for yourself, your spouse, or your common-law partner. Medical expenses include:

- Prescribed medicines

- Health insurance premiums and therapy

- Dental

- Baby-breathing monitors

- Crutches, Lenses or Glasses

- Service animals

Some important notes about medical expenses are that they should be reduced by 3% of your net monthly income (or $2,479, whichever is less.) Then, the tax credit is 15% of the amount remaining on the expense.

What is a TD1 form and how do I fill it out? What are the T4 & T4A forms for? Watch the video and download the guide to find out.

4. BC Renter’s Tax Credit

New for the 2024 tax year, the B.C. Renter’s Tax Credit gives up to $400 to eligible individuals & families based on income. To qualify for this credit, you must have rented an eligible rental unit in B.C. for at least 6 one-month periods. Individuals and families with an adjusted income under $63,000 qualify for the entire credit, with those earning between $63,000-$83,000 eligible to receive a reduced amount.

3. What’s new for the 2023 tax filing season

In the final section of our webinar, Paula and Natalija break down all the important changes landlords should be aware of for 2025.

1. Deadline for filing

For 2024, the deadline to file taxes and pay any amount owing is April 30th.

2. Home office expenses

A lingering tax implication is home office expenses. With many workers suddenly having to shift to remote working from home, not everyone was set up for it.

The home office expense is available to anyone who worked from home for at least half of the time over a consecutive period of four weeks or more because of the pandemic.

This year, it is only possible to claim work-from-home expenses using the Detailed Method.

Detailed process

This is meant to cover different expenses like office furniture, supplies, and even bill payments that .

However, you do need employer approval for this credit. You’ll need to have a form T2200 completed and signed by your employer.

About TurboTax Canada

TurboTax® is Canada’s #1 tax preparation software to file taxes online. No matter your tax situation, TurboTax® has you covered. Prepare and file your taxes online securely with 100% accuracy.

Rethink The Way You Rent

Not on liv.rent yet? Experience the ease of digital applications & contracts, verified tenants & landlords, virtual tours and more – all on one platform. Sign up for free or download the app.

Subscribe to receive the latest tenant & landlord tips and get notified about changes in the Canadian rental market.

>> Stay up-to-date on the average rent in Vancouver, Toronto and Montreal: Rent Reports.

0 Comments