Inflation and the corresponding rise in interest rates are on nearly every Canadian’s mind. Practically everywhere one looks, there’s talk about the far-reaching consequences of these important financial indicators – but how will these seismic shifts affect landlords and real estate investors? Those who own rental properties will certainly feel the impact of Canada’s rising interest rates, in several important ways. We’re already seeing rent prices climb higher as landlords adapt to higher mortgage rates, house prices, and other factors – but that may be all set to change. Today, liv.rent will walk you through exactly what a change in interest rates means for Canadian landlords, in terms of the overnight rate, mortgage rates, home sale prices, and more.

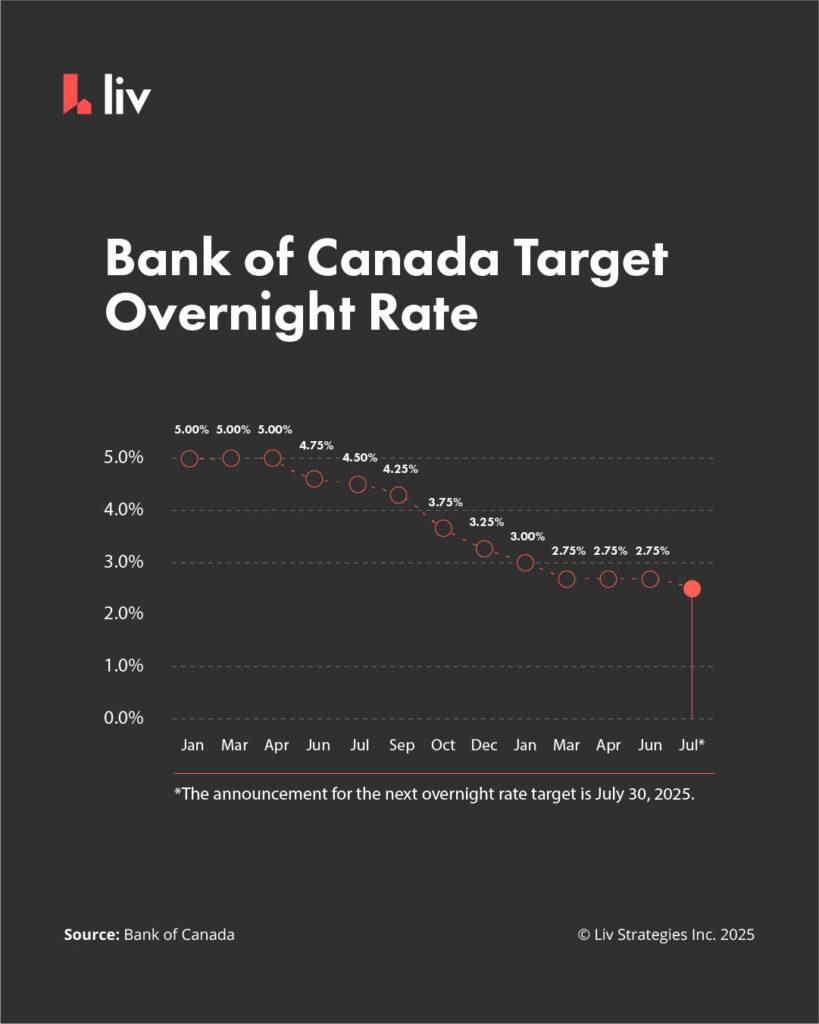

Note: This post has been updated to address the June 4th, 2025 announcement from the Bank of Canada.

Is your rental priced competitively?

Find out with a free rent estimate. Our team of rental experts will calculate your unit’s true value based on your listing details & current market trends.

What is inflation?

Inflation is a hot topic at the moment, but what does the word actually refer to, and what are its tangible effects? In the most basic terms, inflation refers to the gradual rise in the price of goods and services over time – or more specifically, the decrease in purchasing power of a currency. This is typically seen as an aggregate measure of the general cost of living, which results in a slowdown of economic growth since individuals have less money to spend on non-essential goods.

At present, Canada’s inflation rate stands at 1.83% as of December 2024. For context, The Bank of Canada strives to maintain a 2% inflation rate each year as part of its mandate. This rise has led to and is the result of, a number of factors. One example is grocery bills increasing by 4.3% last year alone. In terms of real estate, inflation also has some bearing, leading to generally higher housing prices across the board, although it isn’t the only factor driving Canada’s currently sky-high housing prices.

What do interest rates represent?

The majority of Canadians are already familiar with interest rates in their daily lives, but it’s important to clarify for this article. Broadly speaking, interest rates are the amount that a lender charges a borrower over time, generally expressed as a percentage of the principal loan. On a federal scale, there are two primary interest rates that individuals, and homeowners in particular, should be concerned with: the overnight rate, and the prime rate. The former is set by the Bank of Canada itself, while individual banks determine their own prime rate. Here’s a brief explanation of each:

Overnight rate

The overnight rate is set by a country’s central bank and is an indicator of the rate each individual bank will set since they’ll need to cover this rate while still earning a profit overall. When The Bank of Canada raises the overnight rate, it becomes more expensive for banks to borrow money and those costs get passed onto borrowers through higher prime rates.

Prime rate

The prime rate represents the base interest rate that a bank will lend money for in order to cover the overnight rate, as well as account for its own operating costs. This does not mean that this rate is the actual rate that customers will be offered since individual clients can receive discounts based on a variety of factors.

How interest rates relate to inflation

Interest rates are fundamentally tied to inflation since the former is one of the main methods used by countries’ central banks to control the economy. Higher interest rates can be seen as encouraging saving while discouraging borrowing and spending, while lower interest rates are more amenable to higher levels of spending. In response to high interest rates, businesses will typically increase the price of their products more slowly, or even lower them to encourage more spending. Similar effects can be seen in the real estate market. As would be expected, high interest rates make qualifying for mortgages harder, thereby lowering demand which gradually causes home prices to fall accordingly.

It makes sense then that during periods of high inflation, central banks would want to raise interest rates in order to lower prices over time. This is essentially what we’re collectively witnessing now – albeit on a larger scale than we’ve seen in recent memory. Still, it’s important to keep in mind that these changes are always temporary as markets tend to stabilize in due time and that is what we are beginning to see now.

Interest rates and rental properties: what landlords need to know

As interest rates begin to come down, Canadian landlords will likely feel the impact in a variety of ways. Rent prices may begin to fall as interest rates begin to come back down. Another consequence of lowering federal interest rates is that there will be a decreased demand for rentals in many markets since more potential homebuyers will be able to afford to borrow money.

To give landlords a better sense of what interest rate coming back down will mean, let’s look at three areas where many landlords will notice changes: mortgage rates, credit card interest rates, and savings accounts.

Mortgage rates

To properly explain how mortgage rates relate to inflation and changing interest rates, it’s first important to differentiate between fixed-rate and variable-rate mortgages. If you’re a landlord, you’ll likely already be familiar with these two terms and how they differ. Just in case though, let’s quickly look at the differences in each and how each will be affected by recent events.

Fixed-rate mortgages

Fixed-rate mortgages are a type of mortgage that charges a set interest rate throughout the lifetime of the loan. For those who already own property with a fixed-rate mortgage, good news – you won’t be seeing any difference in your mortgage payments, regardless of how much interest rates increase. In fact, this is one of the main reasons why homeowners opt for fixed-rate mortgages since they offer far more certainty during periods of higher inflation.

On the other hand, if you’re looking to purchase a property in the near future, be aware that it becomes much harder to qualify for fixed-rate mortgages particularly when interest rates are high. This is because payments will be higher if you’re mortgaging a new home during these periods, so stress tests (also known as qualification rates) will be more difficult. Currently, The Bank of Canada‘s qualification rate is set at 2.75%, although most homebuyers will secure a rate of 1.75% or above, which means that they’ll be stress-tested at their rate plus 2%.

Variable-rate mortgages

Variable-rate mortgages are where landlords and homeowners will see their monthly payments increase or decrease depending on current interest rates. Since by definition the interest rate isn’t fixed, variable-rate mortgages are liable to rise during periods of inflation when prime interest rates increase and fall during periods of stabilization.

Credit card interest rates

For landlords who use credit cards to finance day-to-day expenses for their rental properties, you will be happy to see federal interest rates coming down. Since merchants such as credit card companies also experience the same level of interest rates as banks, this change will be passed on to individual customers.

Savings accounts

Interest rates coming down may signal the end for those savers who had previously taken advantage of the high interest rates. This may be the opportunity they have been waiting for to take their money out of savings and begin to invest again.

How will stabilising interest rates affect rental prices?

Rent prices are fundamentally tied to inflation since they reflect a core part of the cost of living. As inflation rises and falls, so too do rent prices. While in the long term, interest rate hikes are intended to tame this inflationary pressure, the opposite will likely happen in the short term.

At present, lowering interest rates are being reflected in landlords’ mortgage payments. This means that many landlords who are re-listing their units may decrease their rent prices as costs ease. Landlords with existing tenants should they choose, will only be able to raise rent by the provincial maximum in provinces such as B.C. and Ontario.

The reasoning behind these high interest rates for rental properties is that lenders perceive the risk of an investment property to be higher in times of inflation and eventually recession. This risk will be reflected in the price of the mortgage, which in turn is reflected in the cost tenants pay to rent the property.

Mortgage rates for rental properties

Those looking to purchase a property right now should know what to expect when it comes to the mortgage rates they’ll see. As interest rates begin to stabilize, so do mortgages.

The precise rate you’ll be paying depends on many factors such as what type of institution you’re borrowing from, your own finances, where the property is located, and the type of property you plan on purchasing. With that being said, the lowest rate for a 5-year fixed-rate mortgage is 4.39% according to Wowa.ca, while the lowest rate for a 5-year variable mortgage is 5.4%. This is a sharp increase from pandemic lows of around 3.2%.

Mortgage rates are almost always higher for rental properties too, since lenders prefer the security of owner-occupied residences. It’s always best to work with a knowledgeable mortgage broker to find the best rates for your needs and don’t be afraid to shop around before making a decision.

What’s next for Canada’s interest rates?

Canada’s economy is showing promising signs that inflation is beginning to slow, and the Bank of Canada’s monetary policy is following suit. As of June 4th, the Bank of Canada has announced that they are maintaining the overnight rate at 2.75%. The next announcement is scheduled for July 30th, 2025.

Even with interest rates higher than in previous years, this situation certainly isn’t all bad news for landlords. For those who already own a rental property, expect to see high demand persist for the foreseeable future. Although interest rates are beginning to fall we can expect to see the same high levels of demand in the rental market as factors such as high housing prices, high immigration and high cost of living still play a role.

What will Canadian interest rates be in 2024?

While fears of a recession still loom, recent job numbers are above what was expected. Though the worry remains that a recession could be looming later in the year, there’s reason to be hopeful given that unemployment rates and consumer spending show promising signs of a “soft landing”.

FAQ: Interest rates, mortgage rates and rental property

Does a rental property have a higher mortgage rate?

Yes. Rental properties will almost always have a higher mortgage rate as they’re perceived to be riskier by many lenders since they won’t be owner-occupied.

What is the mortgage rate right now in Ontario?

As of June 2025, the best rate for a 5-year fixed mortgage in Ontario is 4.04%, while for a 5-year variable mortgage, the top rate is 4.65%.

It’s always best to consult the latest numbers before making any investment decision.

What are current mortgage rates in Vancouver, BC?

As of June 2025, the best rate for a 5-year fixed mortgage in Vancouver is 4.54%, while for a 5-year variable mortgage, the top rate is 4.54%.

It’s always best to consult the latest numbers before making any investment decision.

Will mortgage rates go up in 2025?

With the recent rate announcement, the Bank of Canada has decreased the target overnight rate further. However, it remains to be seen if rates continue to fall or if they will remain at their current levels through the remainder of the year.

Why are interest rates higher for rental properties?

Mortgage rates are typically higher for rental properties since lenders see non-owner-occupied properties as a riskier investment.

How much higher is the interest rate on a rental property?

This once again depends on the situation, but investors can expect to pay as much as 0.6% more for a rental property compared to an owner-occupied residence.

What is a good ROI for a rental property?

A good range for ROI on a rental property is considered to be 5-10% and above.

How liv.rent helps landlords

In times of economic uncertainty, it’s more important than ever for landlords to rent their units quickly and safely in order to avoid vacancies and costly tenant-related issues. Using liv.rent, landlords can rent their unit in as little as 7 days from listing to signing, with digital solutions for every step of the rental process. Finding qualified tenants is a breeze with marketing and rental management features like listing sharing to Craigslist, Kijiji, and Facebook Marketplace, and tenant screening with the Trust Score – powered by Equifax® credit reports. With this all-in-one rental platform, landlords and property managers can fill vacancies faster with verified tenants.

>> Recommended Reading: Landlord Success Story: How To Rent Out An Apartment In 10 Days

Resources for landlords

Here are some additional resources for landlords and investors looking to better understand the recent rise in interest rates and the resulting effects. For more tips and advice on how to rent out your property safely and quickly, be sure to check out liv.rent’s blog.

- Updated interest rates in Canada

- The Bank of Canada – Inflation in Canada

- Understanding the overnight rate

- Canadian Bankers’ Association – Understanding interest rates

For landlords whose mortgage payments have or will be affected by rising interest rates, it’s important to price your unit correctly in order to keep your rental property profitable. If you’re considering increasing the rent, be aware that each province has a maximum allowable rent increase. For 2024, Ontario has set this limit at 2.5%, while B.C. has outlined a 3.5% maximum rent increase guideline.

Here are some additional resources related to rent prices and increases:

- Landlord Guide: How Much Should I Charge For Rent?

- Ontario – Residential rent increases

- B.C. – Rent Increases

Rethink The Way You Rent

Not on liv.rent yet? Experience the ease of digital applications & contracts, verified tenants & landlords, virtual tours and more – all on one platform. Sign up for free or download the app.

Subscribe to receive the latest tenant & landlord tips and get notified about changes in the Canadian rental market.

>> Stay up-to-date on the average rent in Vancouver, Toronto and Montreal: Rent Reports.

0 Comments